EURUSD reached the area of 1.07 during trades last week. The chances for stable growth even higher are much bigger in the second attempt. The downtrend of the pair faded at the end of December. The renewal of many-years lows at the beginning of January, probably, turned out to a desperate attempt of bears to accelerate their attack, but it failed. Rally of dollar and stock markets caused by trump's election was quite significant, and now the serious correction is obvious, otherwise dollar and stock markets would need an important reason to continue growth. In such conditions the traders prefer “to sell facts”, i.e. to get into defending position by the inauguration of Trump. Moreover, at the beginning of the week dollar was hit by Trump's announcement that the strong dollar creates obstacles for the USA to compete with China. Hence, based on the first three weeks of the current year the trend for growth of the pair is showing up. Meanwhile, 1.07 level appears as an important line. The confident spike up in the beginning of the next week will let to consider the situation as something more rather than correctional pullback as per Fibonacci. Since Trump should move from his promises to actions, he will need time for consideration and delivery of the certain programs, therefore, dollar again will be influenced mainly by macroeconomics and Fed's mood during coming weeks. yellen continues to persuade markets in necessity of the further rate hikes, not waiting until the inflation djinn is out of the bottle, in order to pressure breaks not so hard later. This is the hint for the several hikes during the current year, until the inflation pace (deflator of the core consumer expenses, Core PCE) goes higher than 2%. Especially that core CPI is not declining below that level for a year already. At the same time we should remember that Yellen is very often has cautious and dovish positions. That's why markets' hesitations of her determination to make three hikes are well-ground. Together with the correction of “trump's rally” the above prevents the treasuries yield growth and dollar strengthening.

The week began expectedly badly, but it closed either expectedly well. Why? Because lately the things which are really bad for the British currency happen surprisingly, while the expected bad news either do not cause a negative reaction or do win back by the market backwards. Secondly, the British pound rose up to the levels from the beginning of the year and again skyrocketed to the support level above 1.21 and touched 1.24. During this month pound could not break the resistance displayed as 50 –daily MA. Now the pair is again at the line. Probably, next week dollar's weakness will help the pound to go upper.

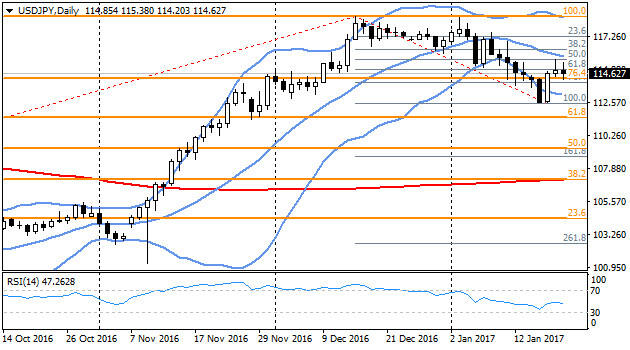

The correction impulse of USDJPY, probably, is breaking into several waves, but still it is keeping the declining mood. Last week the pair soared from 112.50 to 115.60 but it again turned back to decline on the back of common cautious attitude against dollar. The lower line of Bollinger Bands indicator has been crossing by the pair's quotes the most time in January, showing a strong bearish mood. Now the pair is closer to the central line, pointing out the correction of the short positions. It is difficult to understand now if the correction of the big rally (110-118.60) will stay unfinished or it is just a small halt on this way.

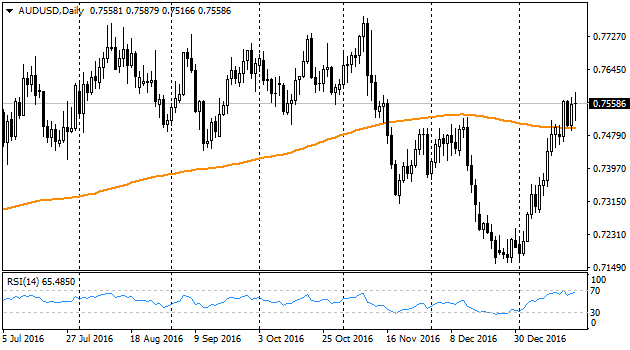

It looks like, aussie is far away from all the hesitations of the mentioned above pairs. It continues to grow the third week in a row, and it recovered already its decline since the middle of December, proved confidently its possibility to stay above 0.75 and makes attempts again to climb to August – November trading range (0.7550 – 0.7750). Housing and job markets are not drivers of growth so far, but at the same time they do not pull the economy down, showing the moderate growth pace. Meanwhile, inflation is giving signals of accelerations, which should be reflected in the policy of the RBA. They should wait for more hawkish attitude of the country's Central bank in the coming months. Particularly as metals' prices finished obviously their many-years falling.