The pair started the week and continued its serious growth trend, but it could not keep this pace, having stumbled on Thursday. As a result, euro dropped from the resistance area around 1.0760 almost by a figure. However, dollar bulls could not use the situation to the full extent: the pair stabilized and ended the week a bit above 1.07, actually where it has started the week. On the back of the above process, there was another series of highs renewals of the US stock indices. On Thursday and Friday, those processes a bit slowed down due to profit fixing, which actually resulted in the incorrect spike for dollar demand. The markets look quite fragile now, as they climbed up too high on the expectations of the measures, while the economy started giving the signs of the chilldown. But the latest fact is actually playing against dollar, so the further dollar trend will be ruled by the Fed Reserve, which meeting is ahead next week. In December, the Open Markets Committee surprised us by the raise of forecasts and the expected number of hikes in 2017. Meanwhile, the market majority is waiting for the next rate hike in the next half-year period. If fomc agrees with the above, the comments would not differ a lot from what we saw in September and November of the last year. In case the attitude becomes more definite, we will see more concerns about inflation and notice about new and soon policy tightening. Firstly, EURUSD will return fast to the trend channel from the beginning of the year, keeping to renew the local highs. Secondly, the pair will start a new wave of decline towards new many-years lows and the recent pullback will appear a slight break in a global rally of the US dollar.

The British currency was accelerating its attack during last week, but it could not get out of the downtrend pattern. The pair was stuck at 1.2670 on Thursday, the mark of the strong ex-support level (closing on July, 7 and August, 15), that turned into resistance afterwards (closing on December, 15). The lower boundary of this downtrend channel is going through closing level of October, 11 and opening level of January, 16. The movement towards lower boundary of this pattern will lead the pair again below 1.20. The British economy showed a healthy growth rate in the IVQ, but they should not rely on this strongly in the future, as the above growth caused by consumption spike in the attempt to outrun the prices rise.

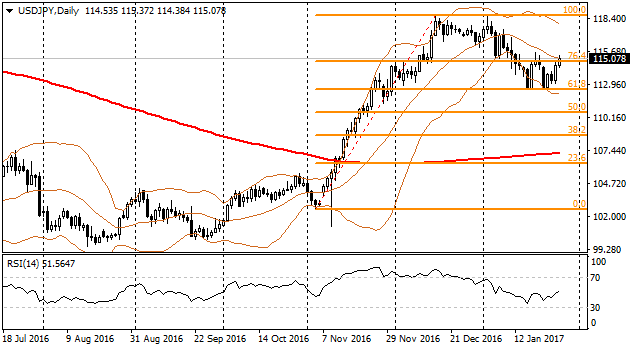

Last week the bank of japan increased bonds purchasing in order to draw 10-years bonds yield closer to zero mark. This caused the firm growth of USPJPY, that moved from 112.50 at the beginning of the week to 115 by the end of the week. In case Fed's actions continue to cause yield growth of the American bonds, the Bank of Japan should significantly increase its bond purchasing in order to reach its monetary policy targets. As a result, the pair USDJPY may become again one of the growth leaders as it happened at the end of the last year.

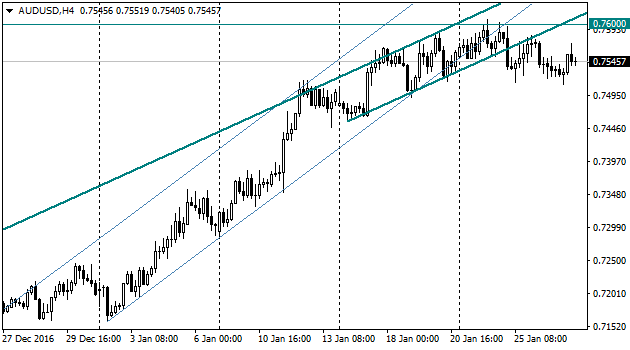

From the beginning of the year, the Australian dollar was experiencing rather bigger rally against dollar than euro was doing, however, even it could not keep its pace. Couple of weeks ago the pace definitely strayed, while last week the pair headed to 0.7510, which is lower than local lows and it is pointing out the possible turn to decline.