It's not a secret that it's possible to make money trading forex in Nigeria. There are many stories of successful traders who have achieved outstanding results. If you don't want to make trading your main business and consider it as an additional source of income, it's fine too. But whatever you decide, when getting started, you will undoubtedly come across a number of misconceptions about trading. In this article, we will take a look at the five common thoughts that may hold you back from trading success.

Thought #1. You can get started with just $100 in your account and earn money fast

When you decide to start with just $100 in your account balance, you should keep in mind this piece of advice from professional traders and trading mentors:

Successful trading starts from at least $1000.

If you deposit less money in your account, be ready to take some major risks. Let us explain what we mean by that:

- To grow your deposit faster, you will have to place more trades. You may think: “More trades, so what? I'll just open and close 5-10 trades every day, and it'll do the trick”. It may be a bit discouraging of us to tell you this, but the hard truth is that in 90% of cases, such an approach will lead you to failure. “The more, the better” simply won't work here.

- When there's only $100 in your account, your risk levels are too high, so you end up breaking the golden money management rule. You shouldn't risk more than 2% per trade, 5% in exceptional cases. So, when your entire deposit is just a hundred bucks, it'll be difficult to observe this rule and your trading may suffer from it.

Thought #2. My trading is fine. It was just one (two, three) losing trade. I don't have to change my trading approach.

If you want to make good money from trading Forex in Nigeria, you should be able to adjust to new conditions, evaluate your trading and analyze if your approach works.

It may be comforting to believe that there's nothing wrong with your trading strategy, that it was just several unlucky trades. The market is to blame, not you. It's also nice to keep dreaming that next time when you top up your account and place a trade, the price starts to move in your desired direction and you close your trade at a profit. But this is not always the case. Are you ready for the trade to close by the stop loss? Are you prepared that the market can go flat for 2 weeks and your trading freezes? To be a successful trader, you should prepare yourself for any outcome. Our advice would be to:

- Risk 1-3% of your deposit in one trade, in exceptional cases – 5%

- Never move your stop-loss and take-profit after you place a trade

- Open no more than 1-3 trades per day

Things will go uphill once you develop self-discipline and become more conscious about your trading process. You can start now by taking a pen and writing down these affirmations:

- I will risk no more than (…) in one trade

- I will not move my limit orders unless there's a critical need for it, such as…

- I can open up to (…) trades per day, no more.

Hang these affirmations where you can see them so that they can be your constant reminder. Just stock to these rules, and you will advance to a completely different level in your trading.

Thought #3. Technical analysis beats the fundamental one

Technical analysis uses a wide variety of charts and indicators that show price over time. You search for chart patterns, channels and study the structure of candlesticks:

Traders consider technical analysis to be more effective than fundamental analysis because the price accounts for everything. Proponents of technical analysis are convinced that to predict the direction of the price in the future – all you need is to analyze how it behaved in similar conditions in the past.

We won't argue the effectiveness of technical analysis. We just believe that fundamental analysis perfectly complements the technical one. And it's not that hard to figure it out as it may seem.

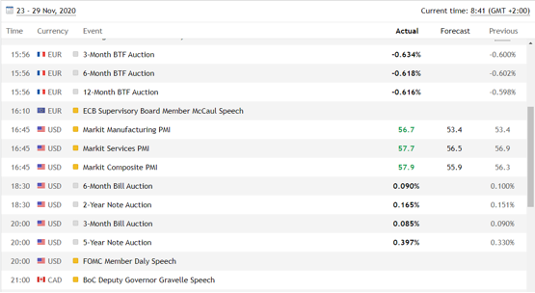

amarkets' calendar of major economic events and news releases

Fundamental analysis is not some complicated science. You can use it depending on the depth of your knowledge. The basics of fundamental analysis include reading analytics, learning the terminology and applying your knowledge in practice.

Thought #4. You can trading using only indicators and make money

There's another popular misconception among traders:

“The indicators are simple. Learn how to use them in a week and make $100 a day.”

While it may sound great, it's not at all realistic. With no trading experience, there's no way you'll be able to learn the indicators in one week and know exactly how to use them. A “week” is definitely not enough.

But in fairness, using indicators in your analysis is extremely useful. It's a part of technical analysis, so we strongly recommend learning how to use at least some of them:

Don't always believe what the indicator shows

In the chart above, we can see 3 indicators. The RSI or Relative Strength Index shows price spikes. When the indicator goes above the 80 mark, the price reverses. When it falls below the 20 mark – the price is likely to start rising. Likely, but not necessarily. You cannot blindly believe indicators and trade based on signals alone. It's a rookie mistake you need to avoid.

Thought #5. You can make money from Forex on a regular basis

Well, this is the last myth. Never expect to be earning money from Forex every day. Only the most patient traders make money regularly. Regularly, but not always. Self-discipline is the key here.

- Choose the strongest chart patterns;

- Use only time-tested indicators. Do not trust “ready-made” trading systems, expert advisors and indicators developed by some unknown trader.

- Keep a trader's log. It will allow you to track your trading history and assess the effectiveness of your current trading approach.

Let's summarize the key takeaways for today:

- Full-fledged trading starts from $1000.

- Revisit your trading approach, get rid of what doesn't work for you.

- Combine technical and fundamental analysis, exploit their strengths and weaknesses.

- Trading indicators alone isn't a way to make money fast. Analyze the indicators together with other market data.

- Don't expect to make money from trading every single day. There may be bad days, there may be drawdowns – be ready for it, don't panic.

Revise your trading strategy based on what we've shared today and adjust it if needed. We wish you successful trading!

Provided by AMarkets