EURUSD

The pair EURUSD went up to 1.1380 that was caused by several factors. The market came through quite good employment data from ADP and again started to sell usd after Evans' comments. Actually his speech was an echo of his boss Yellen's announcements that we heard the day before: declining risks for the US economy, high market volatility, necessity in gradual rate increasing. Though, the common currency is supported as well by the strong EU inflation indicators. Yesterday Germany estimated price growth in March by 0.8%. This is much higher than expected 0.6%. As a result annual pace returned to 0.3% after being at 0% last month. This improvement cannot change a lot the whole picture of the depressed inflation, however, some brightness is brought by the better than expected indicators. Today they continued publishing the inflation data from the euro zone. The actual data was either better than forecasted in March (market analysts were surveyed before the German data was released). The basic index accelerated as well its yearly pace up to 1.0% from the 0.8% last month. However, today we received low data from Germany. Retail sales decreased by 0.4% instead of the expected growth by 0.3%. Unemployed population did not change, though traders were awaiting a small drop by 6 000. Yesterday's ADP Non-Farm Employment Change was close to forecasted levels and average data of the last months – companies have expanded by 200 000 jobs in March. The above is allowing us to expect the same, close to the trend, increase in tomorrow payroll release. Nevertheless, weekly Unemployment Claims that will be leased today may influence the same way dollar movements. Any strong deviation to either of the sides may cause the significant shift and as a result support or pressure the USD.

Cable could not fight for 1.45 yesterday, and by the end of the day the pressure to British currency increased. Today this trend was stopped by the relatively good economic indicators. The final 4Q GBP estimation has shown the growth by 0.6% which was better than reported before 0.5%.The annual growth pace was overestimated from 1.9% to 2.1%. Moreover, published by the Bank of England higher growth of money supply can be considered as positive sign for the pound. M4 Money Supply added 0.9% against expected 0.1%. This indicates indirectly the acceleration of money turnover on financial markets and may push markets to draw closer the date in rate rising that will support either the British currency. Pound could react more inactively if the referendum would not threat the country. As per one of the surveys, 51% of the population support keeping the country in the EU, while only 49% is against it. This is very small difference.

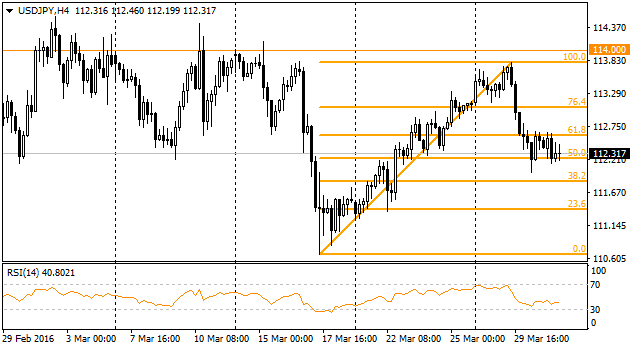

The pair is fluctuating in the tight price range and waiting for the important news release. Meanwhile, Kurodo's words about unlimited opportunities of the bank of japan to lose the policy were ignored by the market participants. USDJPY is close to 50% rally from March 17 till March 29. From this point the pair can move to either side with the same possibility.

Regardless of the oil rally failure, CAD traders have decided to return to the previous trend of selling USDCAD. Somehow it is pushed by the USD weakening but there is still the faith for recovery of Canadian economy and, probably, oil growth while the pair is dropping to lows achieved since the middle of October.