EURUSD

Yesterday Yellen stopped dollar's slow strengthening. After her speech USD started declining in many market. Eventually, EURUSD is again close to 1.1330 – the highs caused by comment after March fomc meeting. It's not clear yet if the pair is going to pass this level but Federal Reserve, obviously, wants to weaken the dollar. Moreover, Fed Chairman has started her speech naming the risks of China's economy slowdown. And market analysts started joking that Federal Reserve became dependant on Chinese data instead of previously dependency on the US data. Though, apart from the pressure instruments on their own currency, FRS has basic reasons, almost the same as other Central banks of developed countries have, the attempt to boost inflation through weakening (non-fortification) of own currency alongside with softer monetary policy than expected before. The bank of japan and ECB could not influence currency weakening by interest rates cutting. Meanwhile, Federal Reserve is more successful in this. But it is better not to interfere to the actions of American Central Bank in this aspect. Weakening of USD should either push the growth of primary assets which often have higher Beta and effect as the inflation stimulus, for instance in the EU. But the main condition here is the higher growth pace of oil prices than euro increase. Employment market data are becoming less important as Yellen has not indicated the significant shift in this market trend regardless of the market turbulence in summer and at the beginning of the year. Hence, traders should not wait for unusual reaction after ADP release from the USA today. At the same time they should remember about releases of March inflation assessment from the different German states during the day, while the consolidated assessment will be announced by the beginning of American session. These releases may affect volatility of the pair.

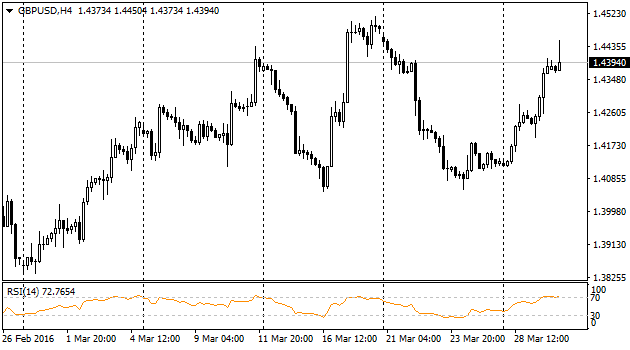

Weakening of the dollar helped pound to develop its attack. The pair is behaving the same way as two weeks ago: increase – stop – increase. Now cable is higher than 1.4420. Its attack could be slowed down by the next survey results where brexit supporters have beaten those who prefer to remain in the union. GBPUSD is still a hostage of market dollar mood as a result of lack of its own macroeconomic data. Moreover, Brexit risks still occupy secondary positions and sometimes they become even primary.

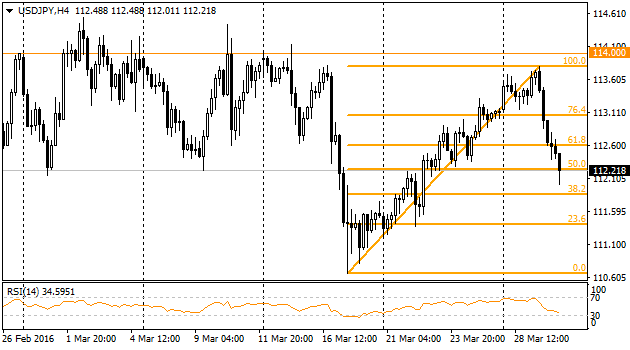

As a snail the pair was creeping to 114, former resistance level of price range. But Yellen's speech yesterday made the traders to turn the movement. For the time being the pair has recovered for 50% from the previous 7 trading sessions, and currently occupies area a bit higher 112. So far its moving is caused by USD and is not reflecting the direct correlations with rising stock markets. During the coming night traders should be careful as a quarter Tankan data will be released. This indicator influences the market quite heavily and is able to affect the trend.

Australian aussie is growing the third day in a row. Today it managed to renew its highs since last July. The main driver here (the same as in the above cases) was the weakening of the American currency. Here we have more chances for the increase perspectives due to getting the former highs along with the confirmation of positive trend acceleration. The previous resistance of rising channel turned to support line in March.