Last week the US dollar was under pressure as the news appeared: trump is cutting his lagging from Clinton. The perspectives of winning by this representative of the Republicans cause the market fever and strengthen the attractiveness of the safe-haven assets. Hence, EURUSD got the double push: caused by deleverage on financial markets and due to the common weakness of the American currency. However, the weekend brought important (as the markets think) reverse: FBI exculpated Clinton, and moreover, the surveys are showing she stopped losing her positions and her raking started to go up again. This all resulted in EURUSD opening with 80 points gap. The markets again are considering the question of the soon raise of the interest rate in the USA, since it is the most probably scenario if democrats keep their power. Moreover, it's time to remember that besides the moderate increase in the occupied population in October, they release a quite impressive wages growth. Fischer has explained that in terms of full employment and current demographic trend, the normal growth should be considered between 65 and 115k. If the experienced banker and the VP of the Fed Reserve is right, the October data turned out to be quite strong. The rate of wages growth in the economy continues to accelerate, leaving behind the inflation rate. This factor influencing the dollar's growth is not weaker than the probable Clinton's victory on the elections this Tuesday. Surely, there are still risks for the dollar. Trump may win or decline the elections results, cutting the dollar's confidence. The primary reaction may be extremely abrupt, so be cautious. The total unrealized during last week volatility may fall to the US dollar on Wednesday in the beginning of the European session.

The British pound went away from the dangerously closeness to 1.2100. This happened due to the weakness of the American currency, along with the unexpected verdict of the London court, stating the Government does not have the right to start brexit procedure before Parliament approves it. The decision will be appealed in the supreme body on December, 5-8. Those days are marked as potentially new threat for the pound. Possibly, the range 1.20-1.25 will be active for the coming month.

Last week USDJPY corrected the half of the growth gained by rally from the beginning of September. However, the pair jumped up this week, probably, having continued the previous trend. At once, from the level below 103 it appeared in 104.50 area. The traders identified the readiness for the further losing policy in the released minutes of September BoJ meeting.

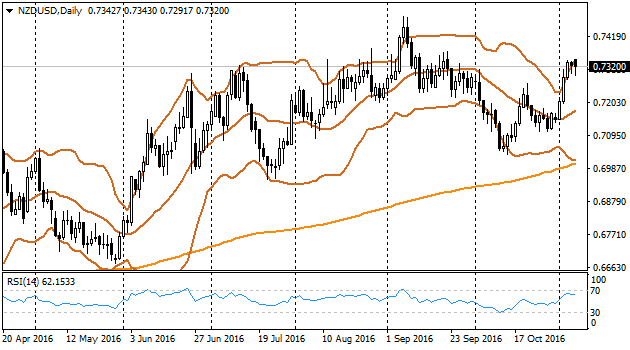

A new meeting of the Royal Bank of New Zealand will take place this week. As a result, analysts are waiting for the interest rate decrease by 0.25%. However, these expectations are not spreading to price declining of Zelanian currency. Since the beginning of the month kiwi has gained two figures and now it is traded above 0.73, on September highs. In a short-term, the currency pair is sensitive as it is staying close to Bollinger bands. We should only wait for its closing below this line. The day closing below 0.7320 may lead the pair down to the nearest target of 0.7200 and the further one – 200 – MA, lower Bollinger Band. All the above are close to round level of 0.7000.