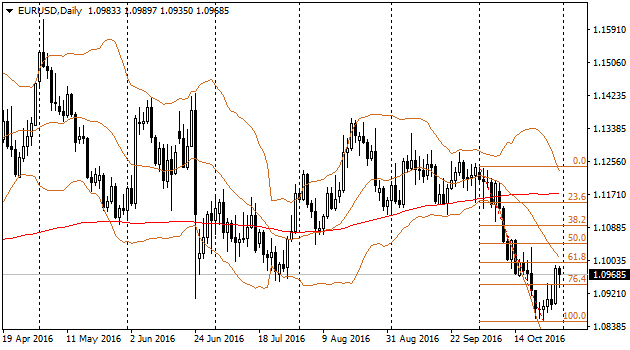

EURUSD started off on the wrong foot the last week obviously. From the very beginning the bears rushed to fight for 1.0850 mark. Later, on Tuesday, they repeated the attack but bulls has managed to keep the key mark, postponing the battle for trend. Most probably, the current or the next week will be vital for the pair's trend. The new week brings such key events for the US dollar as Fed Reserve meeting and October employment report. We do not exclude that cautious Fed Reserve tries to start already on Wednesday, in its November comments, forming the market expectations of the December decision. Therefore, traders should pay more attention to its content and changings than to some previous ones. Friday payrolls will be later than the meeting but FOMC has comparably real information about tendencies of the last month, so their comments will have the needed bias. However, if we look at the situation not trying to guess regulator's actions, we will note the confirmation of the short-term downtrend of EURUSD. Surely, October was a month of the pair's decline. The primary drop from the 1.1250 area has taken the pair out from the short-term consolidation, while decline below 1.09 has broken formation of the middle-term triangle. At the moment the bulls managed to correct its decreasing by 38.2% as per Fibonacci theory. This is actually the advantage for bears – they have opportunity to prepare a new attack and lead the pair closer to 1.05.

GBPUSD

The British currency was consolidating the most part of last week, while the trading range mostly included 100 points between 1.2150 and 1.2250. The markets were reacting a bit mockingly to the GDP releases. The released British data, slightly better than expected, could support the British currency for some hours only, and later on the pair returned to the range core. The US indicators, much stronger than predicted, could not destroy either the market balance: on Monday the pair is traded still there. However, it is unlikely GBPUSD will stay in these tight boundaries after the current week results. Besides the mentioned above events from the USA, the markets' attention is stuck to the rate decision of the Bank of England along with the inflation reports and forecasts. It is not going to be boring.

October has become a trendy month for USDJPY. The pair increased approximately by 5 figures in October, staying above 100 after testing the level in August and September. The reason behind it is the shift in bonds' yields. Such change happened worldwide (yields has grown) but in Japan this change took a place of the obvious and intended policy. Probably, this is the result of that targeted yield curve, which was accepted so skeptically by the investors at the beginning. The bank of japan may show the level of its satisfaction and even strengthen this direction of the movement. In such case, the curve will continue to change in the coming months and consequently the USDJPY growth will be supported.

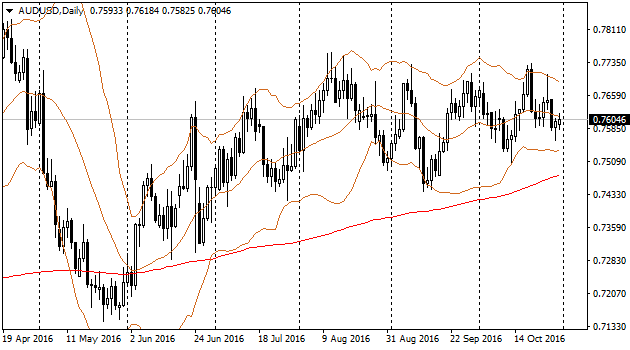

Among the key central banks the Royal Bank of Australia will be the first this week with the rate announcement (in case the Bank of Japan will not be faster). They do not expect rate's change; the Bank's Chairman Lowe was talking quite aggressively during the month, pointing out the positive activities in the Australian economy and decreasing expectations of the further policy losing.