euro continues moving around 1.14 with the support at 1.1350 and resistance near to 1.1410. This week was not full of important macroeconomic reports, therefore many traders were waiting for volatility caused by yellen conference with her forerunners as FRS Chairs – Bernanke, Greenspan and Walker. This speech was less dovish than the previous but not that much dovish to fluctuate dollar. We did not receive any reasons to reconsider rate expectations. The pair could not break the trading channel. Probably, traders were concerned more about other markets and have forgotten about common currency. We can emphasize some good news from the both sides of Atlantics. In the USA again dropped down the Unemployment Claims to 267 k (- 9k per a week). Though, the trend of secondary claims turned to the growth adding 19k, but this goes in correlation with the increase of primary unemployment claims previous week (the data of the secondary claims is late for one week) and needs data confirmation a week later. Today was released quite good statistics of the foreign trade from Germany. Its surplus in February reached 19.8 billion. It is almost the same level that was last year but is worse than in April-June when the common currency was rather weak. The impulse received from the euro weakness last year is losing its power. And they will need additional measures to boost growth in the Eurozone, in case growth is not delivered by the domestic or cross boarder demand (China is the biggest trade partner of Germany outside EU).

Cable is not willing to go far from 1.4 but it is receiving the short-term support with the background of profit fixation by bears and security activation of the important psychological mark by bulls. They are so active that managed to raise GBPUSD in spite of the slow Industrial production statistics that was released recently. Instead of the expected growth by 0.1% the index lost 0.3% in February. Manufacturing production dropped even more having lost 1.1% against forecasted decrease by 0.2%. Production activity is below the last year's level: -0.5% for net index and 1.8% for manufacturing industry.

USDJPY

The pair, probably, has hit the bottom. At least, currently it is adding bit by bit as traders realized that they went too low waiting for intervention for the Ministry of Finance. The stop of USDJPY sales is explained formally by the comment of Taro Aso, the Minister of Finance, who has stressed the undesirability of strong fluctuations on the currency market. The Japanese officials, obviously, are not willing to prevent yen rising. The uncertainty remains in the other question – is there any reason to continue this sales? The surplus of the balance of payments is the highest during last 11 months, the cases o bankruptcy are declining to the last year level, consumer confidence is increasing. Strong economic data from the country can keep the stock market using the low-interest yen.

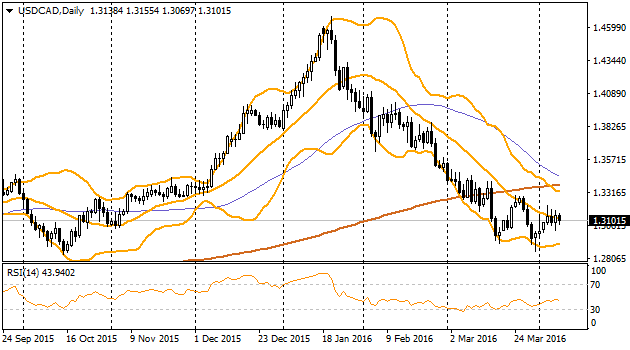

canadian dollar could not find reasons to develop during rather volatile week. Hence, currency trend may be determined again by Canadian data. Today March employment statistics will be released with employed population growth expected by 10.4k. For USDCAD is important either the quantity release of working drilling units by Baker Hughes. The decline of the latest may support the further strengthening of the Canadian currency.