EURUSD is losing 2.5 figures the second week in a row. The US dollar was continuously growing against currency basket during 10 last days. It's hard to find a period when the US dollar was growing so constantly, though the movement scope is rather far from the historical maximum swing. But such movements hide inside the biggest danger. The usd demand, during 2008 crisis, was caused by the liquidity issues, so it was solved comparably simple through supply of the USD liquidity. And now, the dollar is increasing due to the fundamental reasons – on the expectations of tougher monetary policy in the USA during the coming month as well as on forecasting that the economic stimulus of trump's team would arise pro-inflationary mood, making the Fed to increase the rate more actively. In other words, America will not turn into Japan. Surely, it is quite early to make such long-term conclusions, but the mood on the markets has slightly improved. On the dollar demand wave the pair, EURUSD, has dropped to the lows area since last December. Moreover, though the pair was below 1.06 many times during last year, it spent there quite little time, since serious players, probably, were protecting the pair from the decline below the parity. The movement towards 1 or lower will be almost inevitable, in case it may fix below 1.05. On Friday it managed to fell to 1.0570. If we add remaining divergence in the monetary policies of the ECB and the Fed Reserve, will have the following possible scenario. EURUSD experienced a strong decline impulse, therefore it may move to the short phase of consolidation or correction near to the current level and, probably, after the attempt to reach 1.05. Further, with more power, it may make another more successful than in 2015 attempt to take key support, with the possible targets around or below the parity.

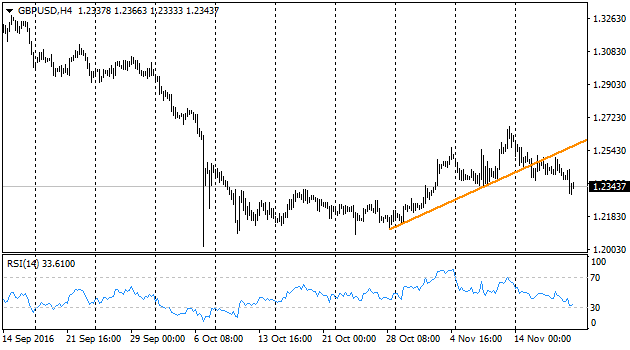

pound lost as well during last week but not so significantly as other majors against the USD. Nevertheless, GBPUSD fixed last week lower than the lows of the previous week, and before the support level of the uptrend was broken. May the released strong retail sales data not to disorient you. Sales splash happened after collapse of the pound. This is the purchasing, made before the goods become more expensive, which means the coming months will show significant decrease of this indicator. Such situations we have observed before both in Britain and Russia, after the Ruble's collapse at the end of 2014.

USDJPY gained almost eight figures for two weeks, at some point getting above 110.90 on Friday. The bank of japan, dissatisfied by the short-term country's bonds yield increase, started to buy short-term equities. A month ago many analysts described the course of yield curve targeting as policy strengthening, but the situation changed, so this buying now is putting extra pressure to short-term bonds yield by Bank of Japan. Technically, the Bank of Japan returned the pair to growth way. It is not surprising, if the pair moves back to the area above 120-125 by the middle of the next year.

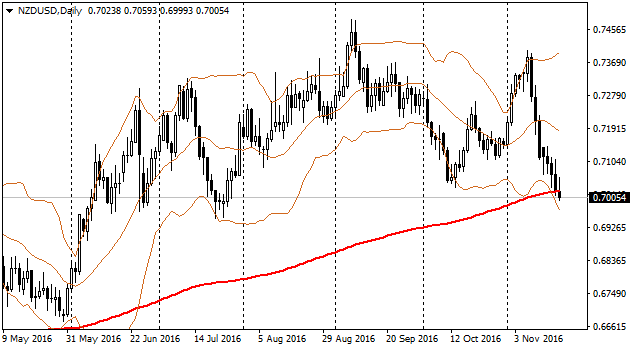

New Zealand experienced a major earthquake, which as well damaged the National statistics building. They started news releases only on Friday and they will continue with delays. It is still unclear if the Royal Bank of New Zealand is going to lose the policy in order to help its economy or it may cause a new wave of houses price growing and lead the RBNZ to implement policy tightening. The first scenario is more probable.