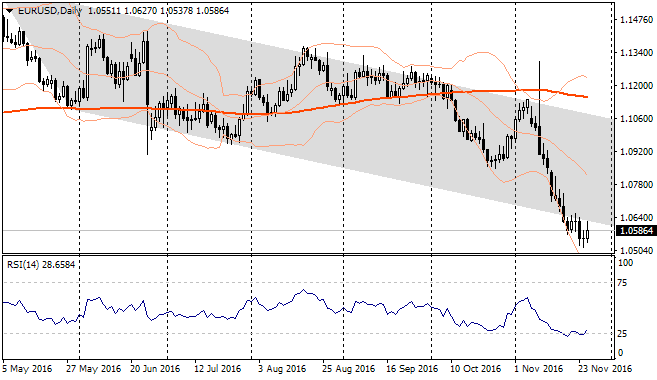

The pair is trying desperately to keep stable after it reached the important support level, which managed to withstand multiple bears' attacks in 2015. However, on Wednesday, which had the full American session on this week, the bears made attempt to press in the important levels. Eventually, EURUSD decreased till 1.0510. The important thing is that the main driver of pair's weakening was escaping to risky assets. Due to the above, the common currency was losing its attractiveness, as during last years. On Thursday and Friday the trades were not so active, so the markets were fixing profits from the beginning of the European session. As per technical analysis, the medium-term perspectives of the pair remain bearish: it broke the support, tried to come back but lost growth impulse quite fast. Moreover, the pair is currently under the ex-support level of the downtrend channel. This level (at 1.06) currently stated as a serious resistance level. Moreover, after a long timeout the strong news started to come from the USA. Companies and households realized that raw materials prices stopped falling, and started to catch the momentum of the lowest interest rates and to postpone the purchases. In case the parity not reached this year, it should be done in the first half of the next year. Otherwise, it will not appear in the coming several years.

The British pound was behaving quite well during the whole week, as the main driver for its growth dealt with risk demand and outflow of funds from the emerging currencies. The second moment should help a bit the pound, while the first one actually helped a bit. Budget renewal is important for the investors, but it did not bring heavy pound reaction. The new Parliament has increased the debts plans and decreased the taxes (not as largely as they promised it in speculations). Taxes decrease is favorable for such economy as Britain. This factor potentially has more influence to the economy than the pound weakening before. The next week is promising to be interesting in terms of fight for 1.25 resistance. In case it breaks up we may confirm that it stopped falling and aimed 1.30.

USDJPY

Yen dropped against dollar much more that other emerging currencies during last week. There are two reasons. Firstly, it is risky assets demand that has made yen the funding currency. Secondly, Asian markets were falling during the week due to cautiousness of protectionism growth in the USA. The above is worsening perspectives for the Japanese companies, although the Japanese stock market itself is growing. The companies situated in Japan prosper when yen is losing its positions. However, big companies, having branches in Asia, unlikely look at it optimistically.

Gold declined below 1200, and taking of this level pushed quickly the precious metal close to 1170. There are the lows since February. Strictly speaking, gold gave up the very next day after Trump's victory in the USA elections, losing the 200-MA support. We may expect that gold gives away all the gain of this year and declines below 1050 usd for troy ounce before the December raise of rate by the federal reserve.