The pair is stuck in the range of 1.1350-1.1400. On one hand, it is under pressure of common feeling for the usd growth, but at the same time, the pair is supported by assets escape, especially visible in Asia. We still forecast more negative risks for the pair. During the last growth impulse last week of March EURUSD reached the highs of the middle of October and it can be currently under short-term pressure. But we cannot exclude either the longer decline wave since the pair has hit the long-standing and relatively strong resistance area. Apart from the strong American data the doves of federal reserve are trying to correct market expectations to be more adequate. Evans (one of them) has accepted two possible options for rate increase this year. Meanwhile, market prices are not involved entirely even for one rate rising. At the same time, Rosenberg said straightforwardly that rate increase is going to happen earlier than expected.

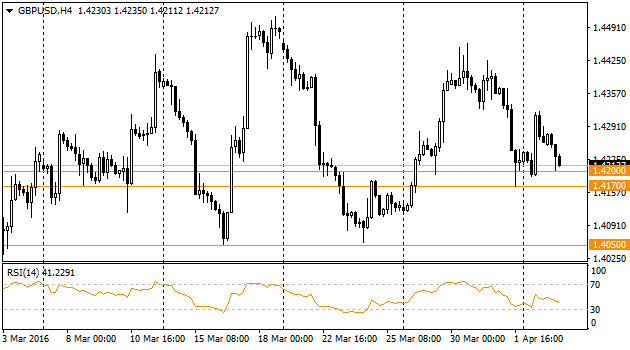

Cable had yesterday several hours of growth closing the day eventually with plus 45 points. It looked more as a small fixation of profits after the powerful movement of EURGBP. Later on, though, selling of the British currency retuned its pace. The nearest targets of bears lay at 1.42 and 1.4170 that will help to move on further to 1.4050. Services PMI almost reached the expected level – 53.7 versus forecasted 53.9. Such deviation is not big enough to press the British currency, but it was enough for bears.

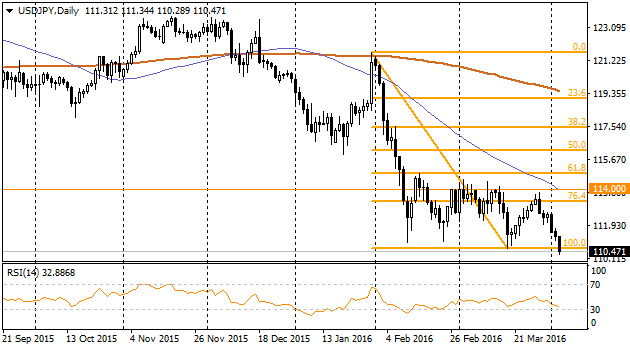

The pair has renewed the lows of a year-and-a-half period dropping at some point to 110.3. In the middle of March irregularly heavy growth at 111 level caused the speculations on interventions of the Ministry of Finance. In case that would be truth, we could expect rebound during today trading session. This brings the idea that the pair is moving down freely following the Asian markets. Kuroda is trying to remind that the bank of japan is on its half way to its inflation target but that cannot bring the proper effect. Probably, that had visa versa effect convincing traders that Chairman of the Bank does not want to continue significant rates decline.

The Reserve bank of Australia has remained the interest rate at 2.0% but the related comment managed in a short term to support the national currency. Currently, the whole AUDUSD growth of 60 points already is covered by market negative attitude. The trades are now at 0.756- level that is week low of the pair. Boost of growth against the market trend caused be Sevens' words that he did not mention before that price of Australian dollar is overrated. Having in mind that RBA sees the close correlation between aussie and metal's prices we can easily explain the metal's price rebound since the beginning of the year. Moreover, Stevens was talking about some reducing of volatility on the markets in comparison with the beginning of the year. Nevertheless, they mentioned in the bank low inflation index and slowdown of Chinese economy. All the above does not allow to exclude the opportunity if rate decrease in coming months given that metals return their downtrend and China remains as a main fear of market participants. Aussie has grown up significantly from the January lows and may request the correction before further increase. Earlier the pair had the strong resistance at 0.74 levels. Now they can become the same reliable support in case the market mood changes. This mark as well is noticeable for 61.8% correction of Fibonacci since middle of January.