EURUSD

Household spending from the USA woke up market participants. Spending of Americans grew in February by 0.1% that is two times less than expected rise and is reflecting January declining tendency. Prices as well could not beat the expectations. Core PCE, the preferable inflation measure of Fed, has added 0.1% monthly after January increase by 0.3%. Though, forecasted increase was 0.2%. Annual growth rate remained the same – 1.7% y.o.y. while the forecasted growth was up to 1.8%. Personal earning continued to increase adding in February 0.2% after raise by 0.5% a month ago and by 0.3% during 3 months in a row previously. Americans do not spend their income as fast as its level comes up. This is a true sign they do not consider the low oil price as something stable, and try to increase their savings to cover oil price rising in the future. Inertia of Americans may be explained as a concern about stock indices collapse since the beginning of the year (the bottom was reached in February) along with the start of the US President election race. Candidates quite often worsen the current situation in their speeches, pointing out the disadvantages and offering their ways of problem solving. Nevertheless, as per fundamental analysis, dollar's decline is caused by Atlanta Fed Reserve reduction of estimation of the 1Q GDP growth from 1.4% to 0.6% that appeared after Consumer Spending release. These annual data is reflecting economic growth near zero level. Today traders will focus on Consumer Confidence data published by the Conference Board. Economists are awaiting the increase in March sentiments index by 1.7 points up to 93.9. That might appear as a compensation of February drop but still will indicate some decline in comparison with strong impulse in December-January. At the same time, the biggest risks are involved potentially in yellen's speech. Many Fed officials lately sound more and more hawkish supported by good indicators and stabilization of stock developing markets. Surely, markets are fragile. Any careless optimism of Yellen may sharply strengthen usd positions as well as bring high volatility, comparable to one in the beginning of the year, to many markets.

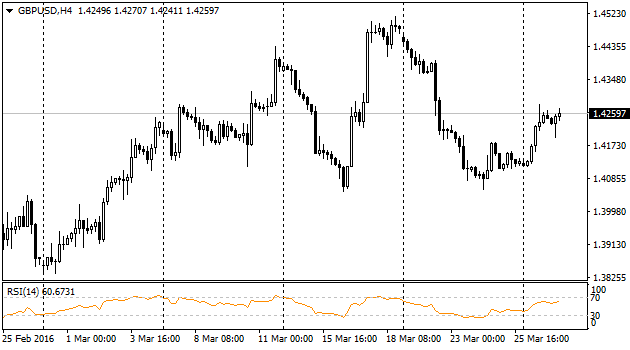

Yesterday's weak positions of American currency were used by pound bulls who attacked levels higher than 1.42. Cable rallied up by 165 points from the day's lows and rebounded later to 1.4250 level. At the beginning of the day bulls were fixing yesterday's profits, though this tendency stopped as 1.42 level support appeared much stronger than bears supposed. As a result, today the pair is trying again to break 1.4250 level. Probably, the pair will be testing yesterday's highs at 1.4280.

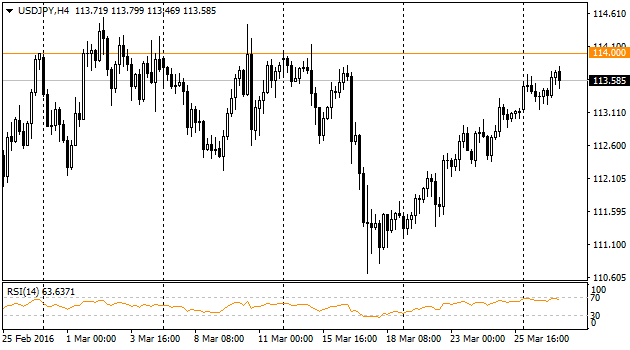

USDJPY growth, quite modest but at the same time long-term, continues its movement. In the related news, we would emphasize the drop in February Retail sales by 2.3%. In combination with the other macroeconomic data of the country, the named release is bringing up chances of postponing sales tax escalating planned before.

Oil weakening did not occur as obstacle for Canadian currency. Starting from the beginning of the week the pair slowly moving back to the area below 1.32, quite risky in terms of oil dropping. It is worthy to pay attention to Canadian PPI release today when low data can slow down pair's decline.