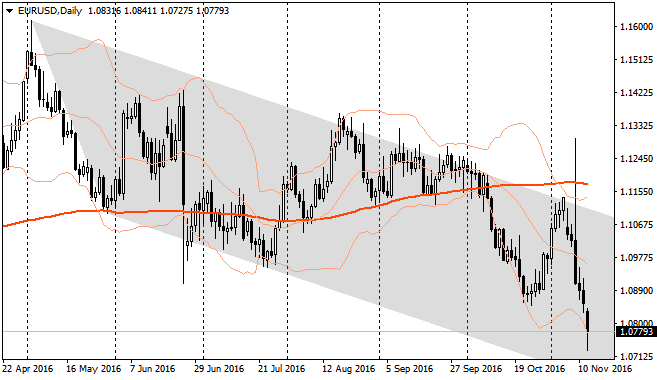

EURUSD

Victory of Donald trump in the president elections caused the volatility splash on the markets, but had not affected key trend at all. Those bears, not forced out by EURUSD three figures takeoff, probably, are feeling great now. The pair is developing its decrease inside the downtrend, breaking on its way the short-term support levels. On Monday opening the support, existing since the end of January, around 1.0850-1.0800 area was broken. In spite of the short-term risks of profit-fixing, the common downtrend, targeting 1.0500, is still active though they should be cautious at the 1.06 level, since the probability of the rebound here within the downtrend channel is becoming the highest. The rate raising expectations by the Fed Reserve in December have recovered until pre-election levels, and it continues to grow, supporting usd. In case Trump gives actual promises for more infrastructural expenses in the nearest future, it may lead to firmer interest rate raising by the Fed Reserve in the coming year, giving strength to the US dollar on the first stages. However, the following risks are remaining: ECB will stop either to threaten us with the soon policy losing and will shift to stimulus cutting, making the direction of the trend in the pair in 3-6 months less obvious.

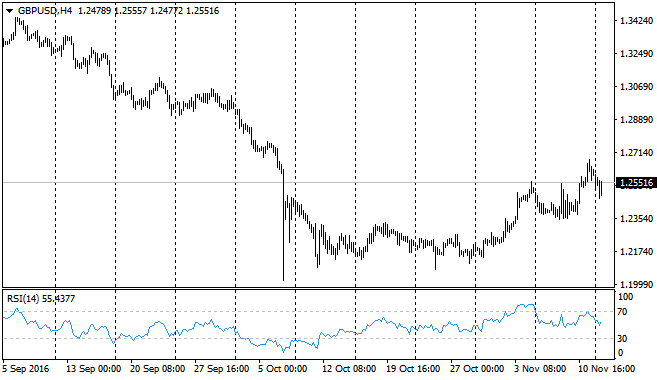

The British pound was growing during two previous weeks, getting under pressure only last two days. For this mini-trend the support level now is around 1.2500. If the dollar bulls are keeping the momentum, reaching this level will result in powerful position closing. As per fundamental analysis, pound is in demand now, as sterling influenced by the movements in the banking sector. The above has started to feel much better when the republican businessman came to power instead of the official democrat.

Yen is experiencing rally during around two months already, having stops rarely on the extreme uncertainty (then the movement slows down) or on the fears (then rebound downwards happens). It is important that the previous week was closed above the 200MA and above highs of the July correction. This will settle a dot for the downtrend movement of the pair, at least in the observable future. The picture is the same for the other yen crosses: the train changed its direction.

Gold is suffering on the USD rise, as well as due to increase of long bonds yields. The markets are feeling well, which means safe-heaven assets are not in priority now. We can observe this on yen movement, but much better it is visible on Gold movement. 200-MA was playing the role of the effective support for it more than a month but it could not resist the flow last week. On Monday Gold dropped to 1212, 5-months low. Gold may lose its positions as the chances of the rate raising by the Fed Reserve continue to grow. The pressure, probably, will be so high at least until the December meeting that they should worry about falling to 1100 area.