eurusd

In our previous reviews, we wrote that the idea is coming back to the market (to buy dollars on the rate increase expectations). The idea was taking out quite cautiously during the last week of September and the first week of October. However, the bears managed to swing the market last week as well as to from a remarkable trend along with breaking some important support levels. In our fist review in October we mentioned that important support levels are 1.1150 and 1.1000. The first one was taken two weeks ago. Bulls tried to oppose, however the selling was activated straightaway after leaving the Triangle. Last week there was a turn of the more serious level. It is an important psychological mark (1.1000) and at the same time the support level of a long-term Triangle, starting from the first quarter of 2015. At the end of the week, the bulls were trying again to challenge the downtrend but the ex-support level appeared as a strong resistance. EURUSD continued to fall. Optimists may wait for the conclusion, testing areas of the previous lows at 1.0950. In case of reaching this mark, they should capitulate. There are enough reasons, which can pull the pair down. They are: release of production data, inflation in the USA and draghi comments after rate decision of the ECB.

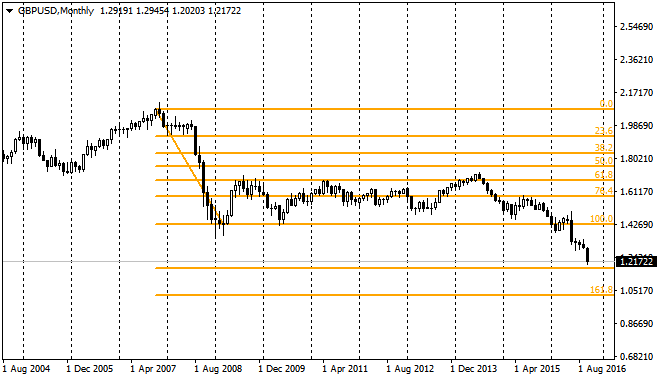

Last week the British currency continued its decline. Now it seems that shocking levels below 1.20 may become reality in the nearest future. Market participants beware of the tough brexit negotiations that may be harmful for economies of the either sides of the English Channel. The sterling has fallen bellow all possible resistance levels. Bank of England is twisting the knife, saying that will turn a blind eye on the inflation. Doubtfully, they may consider 1.20 level as a serious resistance. Sterling can only hope there are no more British currency sellers on the market – everyone who could sell it, did it already.

USDJPY

Total strengthening of the US dollar helps either USDJPY to turn away from 100 level. In spite of the great skeptical talks around, the new policy of the bank of japan based on the yield curve targeting may become more successful than the previous acquisition of public bonds to the Central Bank balance. The pair is consolidating at 104.00, though the break of the downtrend as a whole fulfilled and confirmed. Probably, further we will see growth with some pause.

Gold has dangerously dropped below 200 – MA, and earlier it broke uptrend resistance formed in last December. Gold bulls should note that the instrument may be under pressure until rate increase by the Fed Reserve. Only afterwards, it will turn upwards. At least, last time it happened exactly this way.