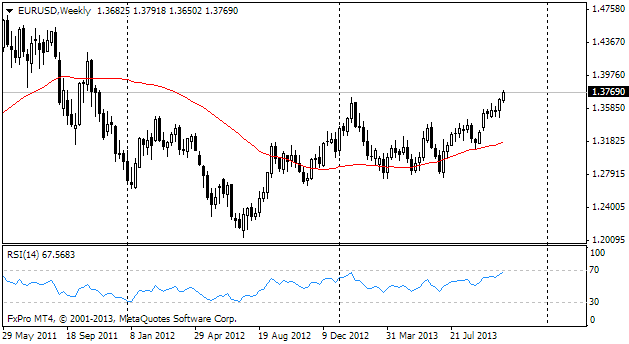

EUR/usd

And again the euro is growing despite the news. The preceding eventful week ended with the US employment stats. The November report met the market's high expectations and even surpassed them somewhere, but failed to produce any continuous effect on the euro, which eventually grew against USD. Now the euro/dollar is above 1.3700, which is the highest level since the end of October and within the reach of a long-term resistance (1.3750). This resistance is rather conventional, so we can hardly expect a burst of activity, should it be broken. The previous highs (1.3785, 1.3815, 1.3830) are of more importance now. If the last one of them is broken, it can trigger a wave of stops which will take the pair much higher. However, we consider this variant as an alternative. The basic scenario is the dollar's appreciation against the euro in the way it is going on in other pairs. Friday's employment data indicated that the employment grew by 203K, in addition to this the employment growth rate in the preceding month was also revised up. Besides, the unemployment shrank from 7.3% to 7.0% and the participation level rose from 62.8% to 63.0% (a bit worse than expected, but it is the first increase over the last five months). Thus we have quite a strong labour market report. Under such conditions the Fed will be simply obliged at least to discuss the cut of the bond-buying programme at the meeting on December 17-18. Since this meeting will be followed by the press-conference, we will be able to learn the Committee's sentiments straight away. Otherwise, we would have to wait for the release of the meeting minutes. After the release of strong employment statistics the market participants will be interested in the commentaries of the Fed's officials to make out the fomc's mood before the meeting. There are a few speeches scheduled for this afternoon. Besides, it will be also interesting to see Germany's stats. The country's trade balance and industrial production rate will be published today. It will be of interest to see what effect the euro's appreciation in the recent months have produced.

GBP/USD

The immunity of the British pound is not as strong as that of the euro, but it is still enough not to fall against the dollar. The cable remains at 1.6340, where it opened and closed Friday. There aren't any particular moves there and absence of statistics from the USA and Britain doesn't promise any strong fluctuations for the most part of the day. Only closer by the evening it would be better to be cautious with the pair, as besides the Fed's officials the BOE's governor Carney will give a speech.

USD/JPY

The Japanese GDP in 3Q was revised down. The initial growth estimate of 0.5% was cut down to 0.3%. The annualized growth (multiplied by 4 for a more convenient comparison with the US data) was revised from 1.9% to 1.1%. It put pressure on the Japanese currency. The analysts more and more point out the necessity of further measures to stimulate growth, which will eventually tell badly on the yen. Now trading is held at 103.00, where the pair was on the first days of December, earlier in May and as far back as October 2008.

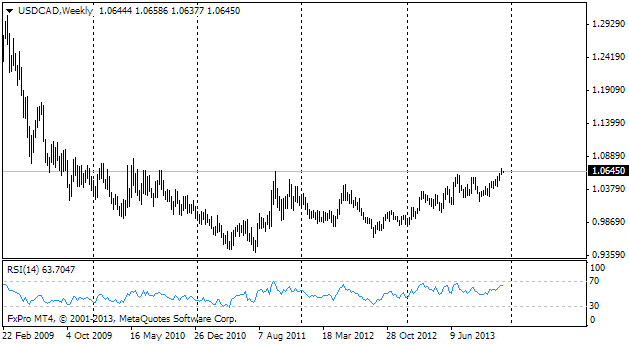

USD/CAD

Friday's employment stats didn't set the trend for the Loonie. The thing is that the total employment exceeded the expectations: it grew by 21.6K against 12.3K, but 20K of it is made up by part-time employees. Such employment won't inspire confidence among consumers. usdcad remains at 1.0650, hesitating to attack new highs while the prospects of the US monetary policy are not clear.