EUR/usd

The ECB with draghi at the head didn't suggest any new incentives or ways to stimulate money supply in the eurozone yesterday, moreover they made it clear that the issue didn't have any discernible outline even in the discussions. In this connection purchasing of the single currency was an understandable and justified reaction of the market. As a result, since the beginning of the press-conference the euro/dollar has grown by about a percent and is trading at the five-week high of 1.3670. But for the strong US statistics, it could be much higher. Yesterday's statistics proved to be much better than expected, once again pointing out strength of economic recovery. The revised GDP stats for 3Q showed 3.6% of the annualized quarterly growth against the forecasted 3.0% and the earlier estimate at 2.8%. Thus, the US economy grew by 0.8% in the third quarter while the EU one – by 0.1% (quarterly). So, obviously the USA is ahead, but for all that the single currency grew from 1.30 to 1.35 over the same period. Surprising? Not very, if we consider the difference in the monetary policies of the regions – while the US Fed purchases 80bln dollars in debt securities monthly, the EU banks have been raising non-euro assets to serve them as a safety cushion during stress-tests. Here we should also add the fact that the ECB's liquidity injections actually don't increase money supply in the system. Today we have the US employment statistics on the agenda. But even if they are favourable, it will hardly change the situation as most are ready for them. Perhaps, the only exception is the Fed, which stated in the Beige Book that the economy was growing at the pace from slow to moderate. With such growth estimate we will hardly see any reduction of the bond-buying programme this month. It only remains to see how the pair will behave at 1.3750, the level of a long-term resistance. Should the US employment data prove to be poor, the pair could probably be driven higher. Analysts in general expect employment growth by 185K. A weaker rate will pose a threat of sharp USD selling.

GBP/USD

The markets didn't expect any changes regarding the sterling, so it showed slack reaction both to the improved economic forecasts by Osborne and to the fact that the BOE's policy was kept unchanged. The reaction was aroused by the release of the US news, which extended the pair's correction, sending it down by a figure to 1.6300. In the absence of important news the pound is gradually sliding down, following the US stock exchanges as all these instruments have demonstrated serious gains, which the market participants will want to take before the end of the year.

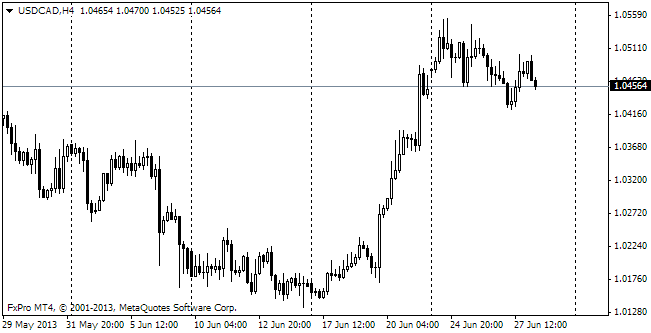

USD/CAD

This week is really eventful for Canada. Besides the interest rate decision, announced a couple of days ago, employment stats will be published today. And here Canada, which recovered well in the first years after the crisis, is sure to get caught in the quicksands. It is expected that employment grew by 7.5K in November, which is below the natural growth rate. The participation rate decrease is also a cause for concern. If actual rates prove to be better, it will enable the Canadian currency to get off the extremums (the multi-year lows against USD).

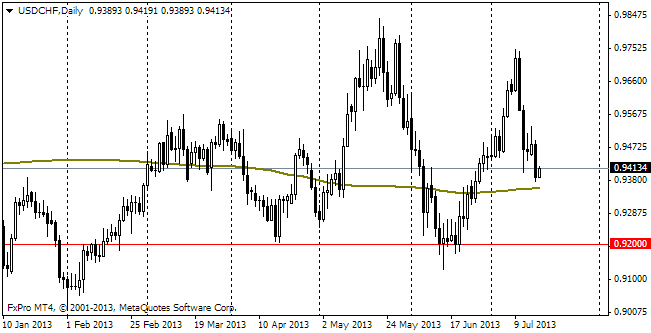

USD/CHF

Switzerland has also been of interest lately. According to the forecasts the country is gradually getting out of deflation (the data will be released in the afternoon), which contributes to strengthening of the national currency. Since the beginning of the month EURCHF has dropped by 50 pips and there are about 50 other pips to the support level. Eventually the franc is growing fast against the dollar, feeling more and more confident below 0.9000. The pair will hardly face any difficulties right up to the support at 0.8900.