Don't you sometimes get tired of hearing: “Beginners shouldn't get into intraday trading”, or “Experienced traders do not trade lower than the daily time frame.”

Well, you are not Warren Buffett yet, and while you don't have millions of dollars on our account, let's be honest: sometimes you do think of venturing into intraday trading and making a pretty penny, or even more.

Our first and most important tip here is:

Intraday trading should suit your personality.

Before we dive deeper into intraday strategies, let us remind you that you can only earn when the trading style suits your personality. Period.

If you like to get things done quickly, if patience is not your strong suit, if you're prone to taking risks, intraday trading won't hurt you.

And vice versa: if you need a moment or two to make up your mind, before making a decision, if you don't like to work in a hectic environment, if you're patient and don't like to risk – maybe you're better off trading higher time frames.

These two descriptions are arbitrary, and your personality may combine some of the characteristics. We just wanted to picture two common trading styles and show which type of traders may be more prone to them.

Now let's move on to strategies.

Momentum

We really want to call this strategy “know your asset”. But momentum sounds cooler.

Why momentum? Because the price moves very rapidly:

Momentum on the chart

Why “know your asset” then? Because momentum is predictable. In the chart, the candles were formed at:

17, 2, 10, 10, 17, 3, 11, 17, 18, 11, 16, 18 … (time of day)

Do you see any patterns?

Let's analyze our information. To do this, let's group similar numbers.

So, momentum in eur/usd is observed:

- From 2 am to 3 am

- 10 am to 11 am

- 16 pm to 18 pm

More experienced traders probably already guessed: it's all about trading sessions.

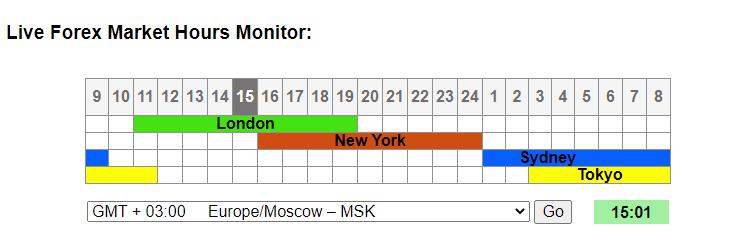

Trading hours, +3:00 GMT

In the chart we see:

- From 2 am to 3 am, the Sydney session intersects with Tokyo

- From 10 am to 11 am London wakes up, where about 40% of all dollars in the world are traded

- From 16 pm to 18 pm London overlaps with New York.

During this time, traders are actively trading EUR/USD. Hence the momentum at the market opening in different countries. There's no magic – it's that simple.

How to trade momentum?

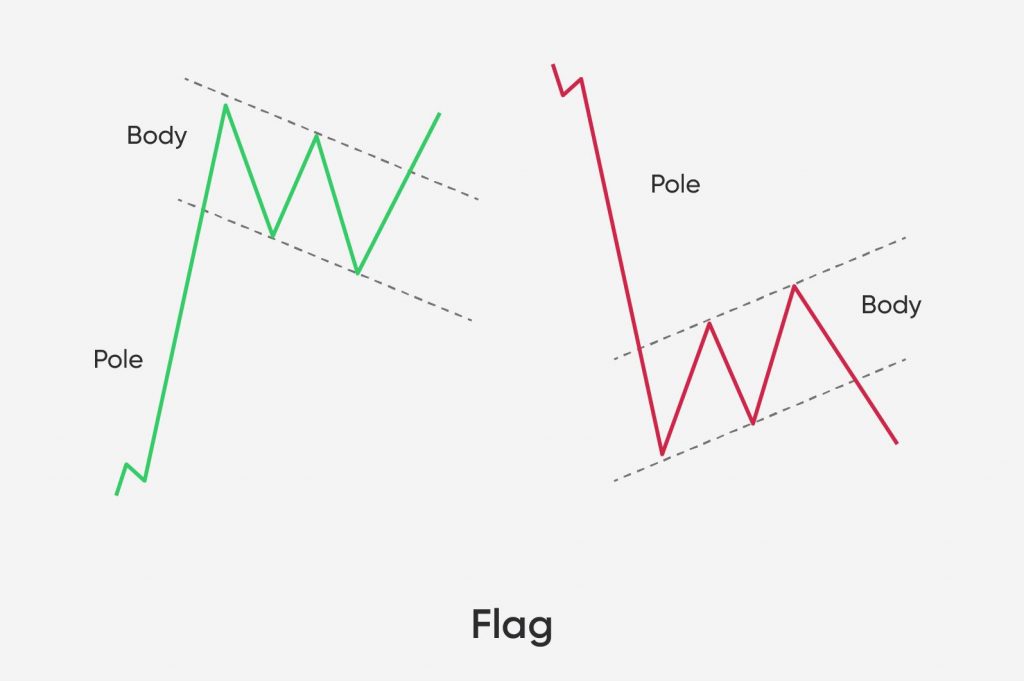

Before it starts. You already know the time intervals when it's observed. Choose any pattern of a strong trending market. For example, bullish or bearish flag pattern:

Flag pattern

Imagine a flag swaying in the wind. If it's hard to picture, let's look at an example:

Now, you probably see the similarity. Our flag, however, is “swaying” in the strong trend.

How to trade the flag chart pattern?

The quickest way is to enter a trade when the price breaks above or below the upper or lower trendline of the flag.

- Spot a flag pattern according to certain criteria (we'll discuss them in a moment)

- And enter the trade at the breakout:

You need to clearly indicate in your trading strategy:

- What criteria do you use to decide whether it's a flag or not?

- What does the flag pattern look like in a rising and falling trend?

- When you can trade it and when you should skip it

Look at this example of 4 flags in a row, get some inspiration and go update your strategy:

Haven't got a strategy yet? Good old notepad will do. Or create a new Word/Google Docs document, it's up to you.

Well, it's time for us to get to the last strategy:

Moving averages

A pretty trivial strategy, but have you ever tried to make money with it?

Moving averages work really well if you know how to filter their signals:

How to interpret the signals of moving averages

- Do not trade their crossover during a sideways trend. It is better to disable them on your chart when the market is flat.

- Add 1-2 candlestick combinations for confirmation.

How about an inside bar known as harami:

Take note that we have a trend line plotted on the chart. It gives us another confirmation signal that the trade should work out.

A couple of tips for intraday traders

Do not rush yourself not to mess things up.

First, you need a trading strategy. And we can't stress it enough (if you have a solid strategy, just skip this piece of advice, it's for those 95% of traders who don't).

Second, set the limit of losing trades per day. For instance, “I cannot afford to lose more than 2 trades per day.” Or “I won't lose more than 8% a day.”

Third. Don't trade lower than the hourly time frame.

Yes, intraday trading should be limited. Do not trade lower than 1-hour chart – it's the golden rule to help you avoid burnout and nervous breakdowns.

Some traders have their eyes twitching just by looking at 5-minute charts. Do you really need all this anxiety?

Well, that's it for today. Join us on social media to find more insightful articles and useful content.

Provided by AMarkets