EUR/usd

Yesterday the single currency fell under pressure and dropped below the support line of the short-term uptrend. Yet, in the afternoon it found support near the lows of the preceding day due to the poor stats from the USA, which saved the pair from further selling. The EU trade balance statistics proved to be contradictory. The seasonally adjusted surplus fell short of the expectations, making €12.2bln against the forecasted 15.9 and the preceding value of 13.8bln. But for all that, the non-seasonally adjusted value of the indicator reached the impressive 21.2bln against the expected 10.5 and the preceding value of 16.7. The values exceeding 20bln are very rare. The last time was in March 2013. Anyway, during the EU session the pair was under pressure because of the comments made by Bundesbank President Weidmann about the economic slowdown in the second quarter, though he promised positive results for the country. Also Weidmann once again emphasized his opposition to draghi's intention to purchase public bonds to the balance sheet of the Bank. Yet during the US session the single currency received a chance to recoup its losses due to the sudden decline of the industrial production index. The latter fell by 0.1% in August after growing by 0.2% a month before (revised down from 0.4%).Besides, instead of growth the Capacity Utilization Rate dropped from 79.1% to 78.8%. First payrolls, then production – too many unpleasant alerts before the fomc's meeting. Today the main risk for the euro is posed by the ZEW Economic Sentiment for Germany and the eurozone. The US Producer Prices will hardly manage to impress the markets so much that it will affect the course of trading.

GBP/USD

Yesterday the British pound managed to hold out due to the general pullback of the EU currencies against the dollar. Today investors are selling the cable out of caution. As has been mentioned earlier, despite it is quite likely that Scotland will remain a part of the UK, there is still a risk that after the referendum the country will demand more independence, which will still have pernicious consequences for the pound. The main threat is in the possibility of changes in taxes and more political independence from Westminster. But today it will be also important for the pair to see inflation statistics. The Consumer Prices are expected to slow down to 1.5%. Should stronger data be released, investors may start build an earlier toughening of the monetary policy in the rates.

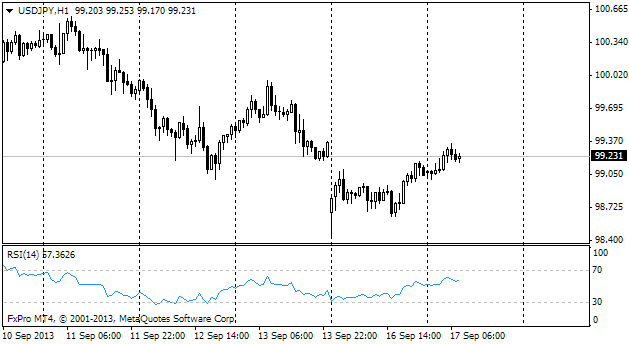

USD/JPY

The pair has slightly adjusted its preceding gains, going down to 107 on yesterday's weakness of the dollar and ‘finishing it off' today by falling to 106.90. Now we already can see how the pair is purchased and is going up towards the highs, hit last week, i.e. towards 107.30. Breaking through 107.40 can provoke strengthening of volatility and the pair's upsurge to new multi-year highs.

NZD/USD

The New Zealand dollar has slightly pulled back, but remained near its yearly lows. Since the beginning of the month the pair has lost about 3% and from the peak of early July – over 8%. It is important that the process of Kiwi's selling went on almost without pullbacks, only with short pauses. Now trading is held close to 0.8160, but after such heavy selling, even if the dollar continues rallying, we shouldn't expect that the Kiwi will fall below 0.8000 in the coming days.