EUR/usd

China has pleased the markets a bit, announcing allocation of funds to five largest banks of the country. $81bln is not a very big sum and bears no comparison to the two preceding programs of incentives. However, the market more and more expects that the National Bank of China will remain on the sidelines at the time of sharp economic slowdown. ZEW Economic Sentiment proved to be stronger than expected and that aroused some optimism regarding the euro. The main index fell from 8.6 down to 6.9 instead of the forecasted reduction to 5.2. The indicator of the current situation tumbled down from 44.3 to 25.4 (against the expected drop to 42.0). So, the German business circles are optimistic about the future. And it is not only because of hopes for easing of the geopolitical situation in Europe. They look positively at the price behaviour, see favourable shifts in the country's trade balance and hope for ‘cheap' money from the ECB's TLTRO. There's little positive in the ECB's actions, but favourable changes in the economy will help to smooth the euro's decline.

GBP/USD

It seems that the British pound seriously intends to close the gap formed a week and a half ago before the fomc's rate decision is published. The cable is trading at 1.63 and yesterday got as high as 1.6310 on the news release from China. Thus, there is only a couple of pips left for the gap to be formally closed. The optimism regarding the British currency is also aroused by the surveys, showing that the opponents of Scotland's independence still make the majority. Apparently, businessmen and politicians managed to bring it home to the Scots that such a sharp secession will entail grave consequences for the business and labour market. As to the latter, today we'll get another portion of employment statistics from the UK. It is expected that unemployment will go down to 6.3%, but many will be interested if earnings are growing faster. There have been lots of problems with it recently.

USD/JPY

It seems that the bears are satisfied with yesterday's decline to 106.80. After this decline systematic purchasing of the pair resumed and now they again bring us closer to the area of the six-year highs. Nomura's experts warn that the yen can continue its depreciation as the Japanese pension funds, with their huge stores of cash, more and more prefer foreign bonds in view of the decreasing yields of the Japanese government bonds. The trend for yields decrease, in its turn, may remain the same as the BOJ is a powerful buyer, taking 70% of newly-released bonds.

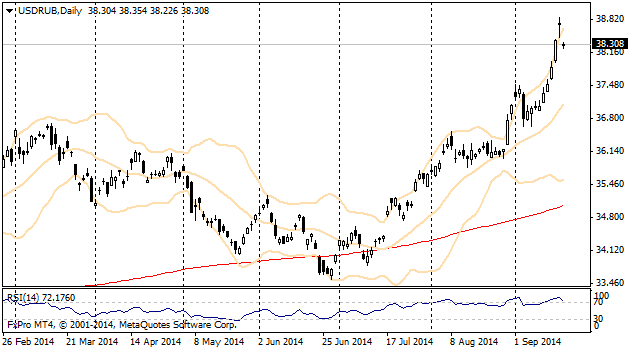

USD/RUB

Yesterday the Russian ruble once again hit a fresh historic high against the dollar, reaching 38.93. However, the situation changed quickly after the Russian CB had announced provision of currency swaps in the stock exchange. Due to this the Russian currency takes attempts to grow. Now the pair is about to leave the overbuy zone, which can be a signal of stronger correction. If the geopolitical situation gets better, it may be quite beneficial to purchase the ruble, first, because of the correction potential and, second, because of swaps.