EURUSD pair yesterday was slowly moving higher though its dynamics was weaker that on such risk sensitive pairs as gbpusd. Although today the common currency, probably, decided to accelerate adding around 40 points during last 1.5 hours and reaching 1.13 level. In a downtrend channel there is still enough place for a growth and without news from Europe the bulls can increase easily their attack pushing euro higher the round mark. Important news will be released only by the beginning of trades in the USA. Durable Goods Orders will be released, and a bit later – CB Consumer Confidence. Durable goods orders fluctuates in the beginning of the year from decline to growth, and now they expect another growth of it by 1.9% after its decline by 2.8%. Ahead of Fed Reserve meeting this is a good indicator for the companies' confidence in the future growth. The weak data will awake another wave of reconsideration of expectations of the economy's 1Q results and once more will confirm that Fed Reserve should not hurry up increasing the rates, not only in April but as well in June. This is the step expected by analysts, those asked by Reuters, but not the markets. This week we have the chance to find out who is going to be right in this opposition – the mass reconsideration of expectations by analysts will happen or the usd movement will lead to second row of policy tightening.

GBPUSD

In spite of our expectations, the reaching to the upper boundary of the trading range was not the beginning of downtrend. GBPUSD is moving further in conditions of quite modest news releases. In such conditions pair can continue its rising targeting 2-months highs at 1.4670. At the same time we should remember that current growth looks rather impulsive meaning it can sharply turn to the opposite side since now trades are going on in overbought conditions. Important statistics will be releases tomorrow at the beginning of London session, the first estimation of 1Q GDP. This data has enough potential to influence the direction of the next trend – will the fluctuations continue inside the range or the long- term rebound from the extremely low levels has start already long before referendum.

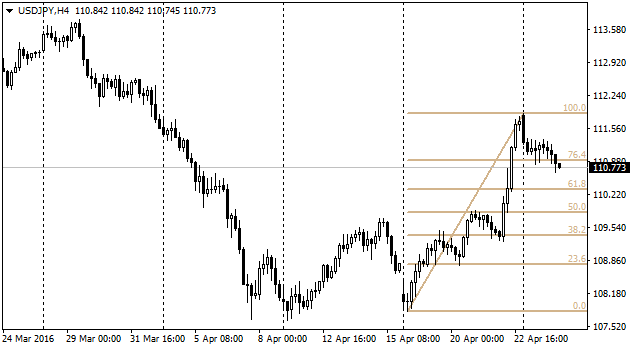

Yen could not find enough supporters and today slowly moved down below 111.0, being yesterday the whole day above this mark, and hit even 110.60. In the first part of the week we do not have much important news from Japan, therefore the pair's movement will be effected by speculations around Central Bank possibility to soften its policy either by rates decline or by QE expansion. bank of japan will announce its decision on Thursday.

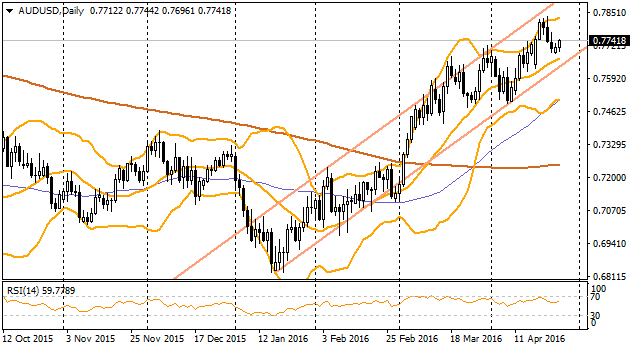

Australian dollar has stabilized close to 0.77, trying this morning to attack in terms of pressure on USD totally on Forex market. In the coming night quarterly inflation will be released that might become determined factor for the next week interest rate decision by the Central Bank. As per expectations, CPI in Australia gained 0.2% during the first three months. This means that annual inflation rate will stay close to 1.7% yoy. In case the actual data differs too much form the expected the Australian aussie may get support as speculations around further possible easing of monetary policy shrink.