EUR/usd

eurusd is already testing the resistance at 1.3550. Actually, the pair has already managed to go above this level, but yet it is too early to celebrate victory over this resistance. Anyway, the fact remains that the pair is still gradually purchased. There hasn't been much news since the beginning of the week, so the market mechanically has continued the same trend. Today it is worth paying attention to the US inflation and retail sales statistics. Existing Home Sales are also noteworthy. It will be statistics for October, when a part of government services were closed for more than two weeks. Returning to yesterday's stats, ZEW Economic Sentiment was of interest. In November the index grew to 54.6, which is a three-year high. This rate meets the average forecast and because of that didn't arouse strong reaction in the market. Yet, it was hardly noticed that the economic sentiment index for the entire eurozone didn't come up to the expectations (60.2 against the forecasted 63.1) and that the Current Situation index declined. The revision of global growth outlook by the OECD also produced no effect on the position of the single currency. The Organization cut the forecasted rate for global GDP growth in 2014 from 4.0% to 3.6%. Despite this, the coming year promises to be much better than the current one with its 2.7%. Also, the OECD called on the ECB to resort to quantitative easing to support the economic growth. But it seems that this method is no longer the most fashionable one. Now the major CBs put a focus on the forward guidance, where they build in conditions to reach certain levels of inflation and unemployment, or simply promise not to raise the interest rates “for a long time”. Judging by yesterday's speech of Bernanke, this approach seems to be more acceptable now, rather than the focus on QE. And it is quite understandable, since the US economy is growing well and changes in the tone of comments have much fewer consequences for the real economy, than changes in the size of the monthly bond purchases. It will be interesting to see if the ECB will act like the Fed, the BOE and the BOJ when they tried to revive their economies, or will turn to modern methods of those who are ahead. Taking into account how much the ECB was criticized when launching OMT, MRO and LTRO, it will be putting off bond purchasing for as long as possible.

GBP/USD

Unlike the euro, the British pound is stalled. The level of 1.6150 has grown into a strong resistance. But it is only because there hasn't been much news about Britain lately. Today the situation may change. The minutes of the BOE's meeting in November will be published. This release promises to be even more interesting than the publication of the decision as it will highlight reasoning of the BOE's MPC. The inflation report has already shown us that the Bank improved its economic forecasts, but additional details may affect the British currency rate a lot. Later there will be a release of the Fed's meeting minutes and there is also something to consider about it.

USD/JPY

The Japanese currency tried to get back above 100 in usdjpy. Yesterday it managed to do it and only today the pair has gone slightly below this level after the release of the trade balance statistics. Exports were growing well last month – 18.6% against October 2012, but imports were growing even faster, 26.1% over a year. As a result – still increasing trade deficit. All this is a consequence of the earthquake, after which it was decided to refuse nuclear energy, which increased imports and energy costs for the country. The low exchange rate of the currency will hardly be of great help here, if it will.

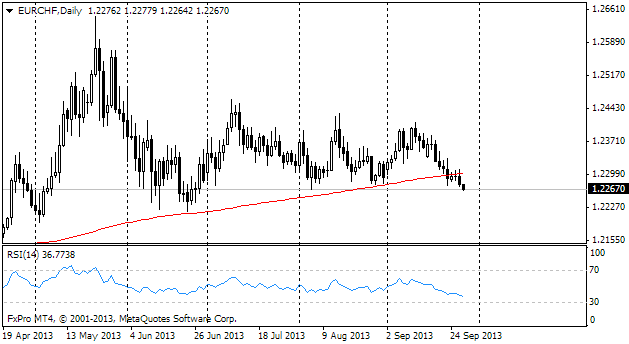

EUR/CHF

EURCHF has all of a sudden gone quiet. Pay attention to it, as breaking through 1.2300 or 1.2350 may provoke a serious movement due to gathering in the stops.