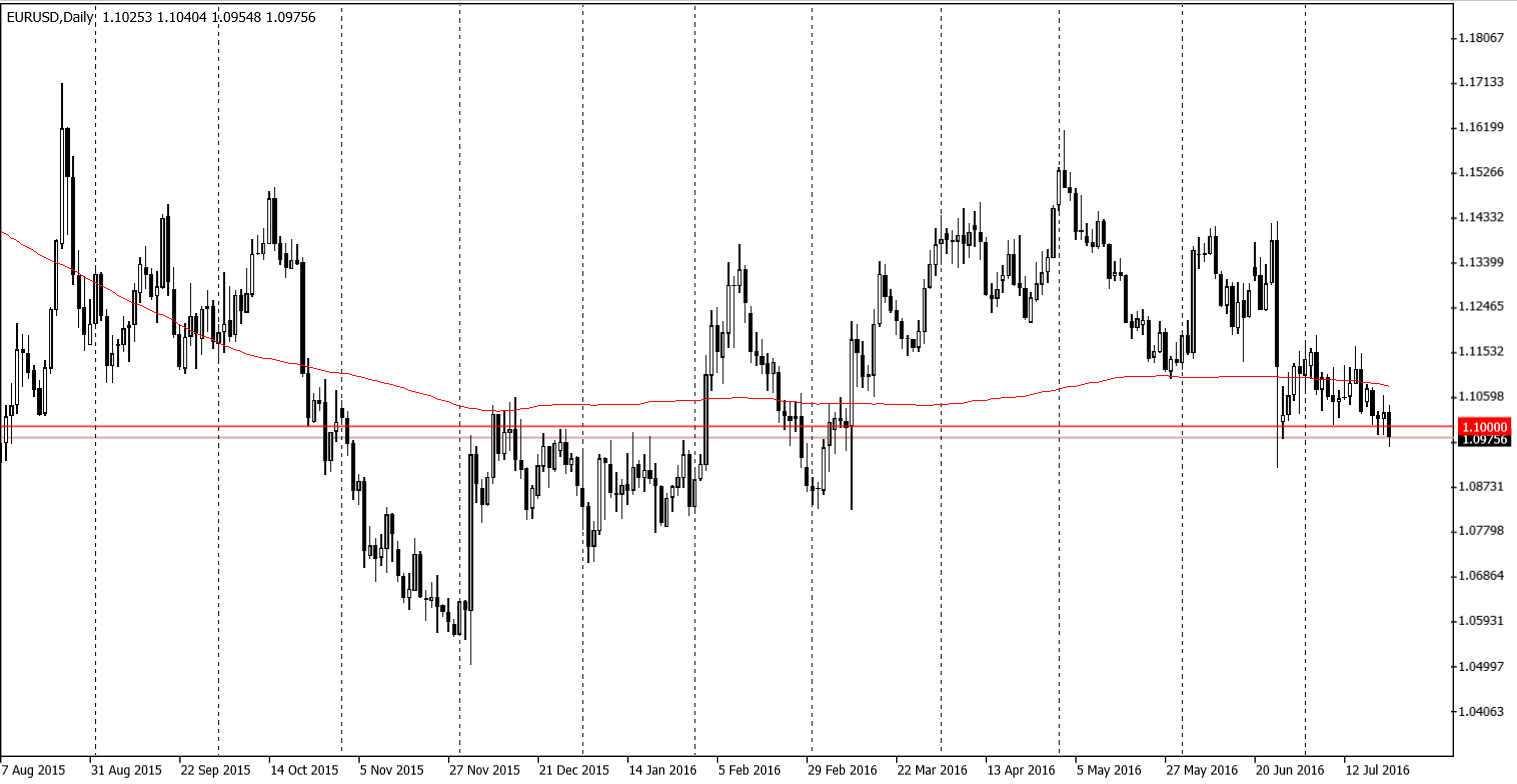

This week good news from the USA economy continued to appear. However, some noticeable strengthening of the American currency came into view only by the end of the week. EURUSD ended Friday trading below 1.10 and was more than a figure away from the 200 MA. Such position allows us to talk about potential for the further decline when the trading starts the next week. Dollar bulls are inspired by the several good releases from the US economy.

Building permits and housing starts were better than expected and indicated the further growth. Existing houses sales reached 5.57 m. showing the highest level since February 2007. That means the post-crisis high was renewed, and the new question appears – is the housing market warmed up too much? On those day of 2007 it was obviously warmed over. Weekly unemployment claims remain on the extremely low levels close to 40-year lows. And this indicator points out very well and timely to the possible turn of the economic trends.

federal reserve would definitely decide the rate question on the coming Wednesday if the external risks of slowdown in China as well as brexit uncertainty would not exist. However, Federal Reserve is paying much attention to external risks, therefore it may not choose this step in July. The biggest setup we may expect from the July meeting is the return of hawkish oratory of the Committee, with the high degree of readiness to raise the rate in the nearest future, in other words in September.

In Europe, meanwhile, the first business surveys took place after the British referendum. German ZEW lost at once 26 points, slipping to the negative side. Preliminary PMI, released at the end of the week, appeared not so cloudy, being better than expectations both – for Germany and the whole euro zone. Compose index of the region decreased insignificantly from 53.1 to 52.9, signalizing modest growth slowdown. It should be worse later on, but still not that much as observers initially predicted.

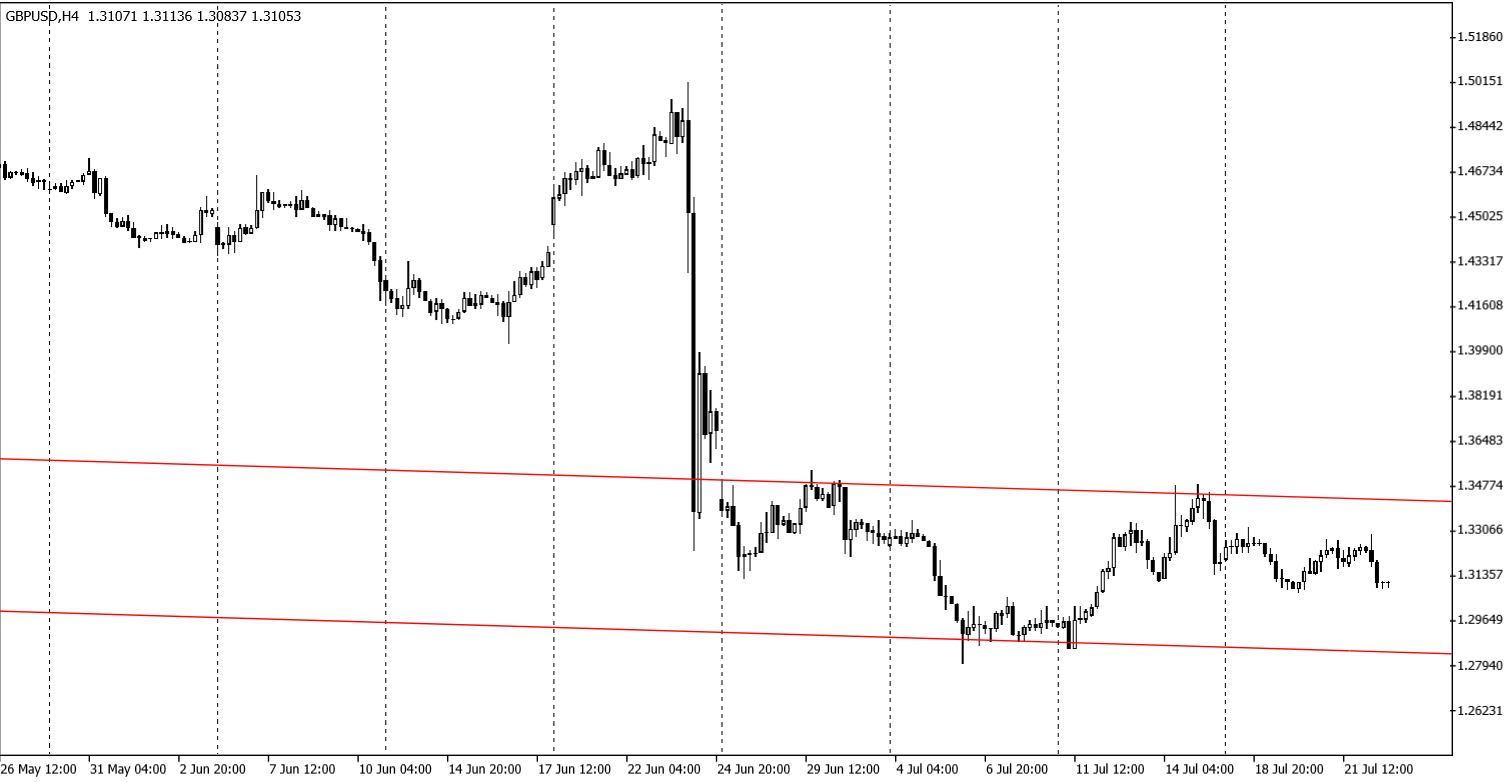

Preliminary estimations of British PMI was not so much comfort. Economic activity dropped at once (indexes dropped below 50), moreover it was more than expected. As a reaction to such low estimation pound has lost more than 1.5 figures against dollar. It settled down below 1.31 by the end of trading on Friday, though it traded confidently above 1.3250 before the publication. Yet, until pound stays remarkably lower 1.30, there is no threat coming from the further wave of selling caused by closing of buy positions. It stays far from lowest extreme points.

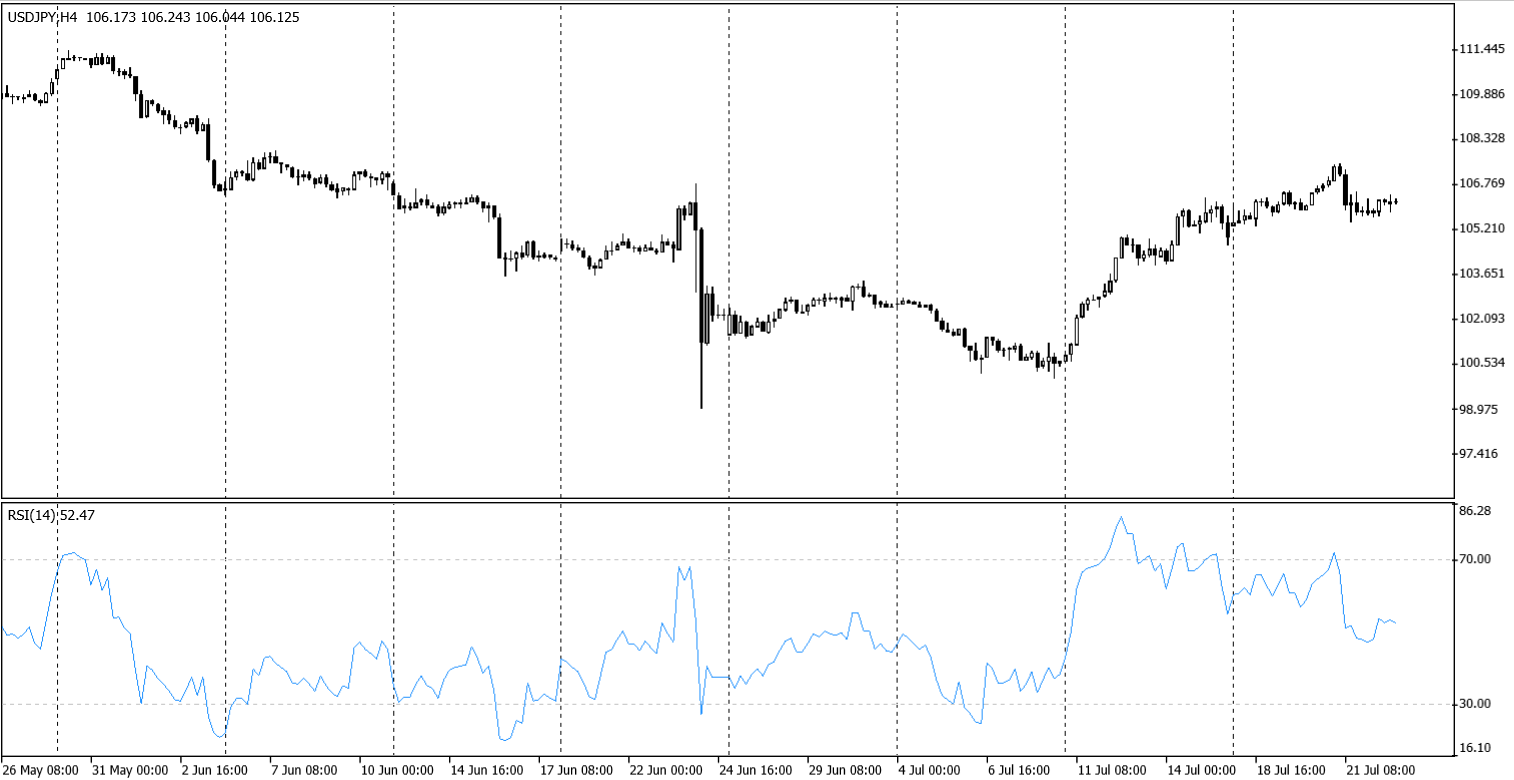

Last week of July is marked not only by the Fed Reserve decision but also by the meeting of the bank of japan. Earlier, during the week, Kuroda hurried to calm dawn markets, saying that there are no necessity and possibility to launch “helicopter money”. But this speech does not exclude further rate decreasing and QQE spreading. Nevertheless, after the comments of the Head of the Central Bank yen returned from area 107.50 to 106 where it consolidated before. The pair will be very heavy if the Bank of Japan rejects the stimulus program to any extent.

Oil is traded in the downtrend channel, though most of the week it spent close to the upper boundary. The prices still pressed by the growth of petrol inventories and production in other counties (regardless of the drop in oil inventories). Another weekly data of working drilling rigs released by the end of trading on Friday. In a week they increased by 15 units. The growth against minimum levels from the end of May is 58 units or 14%.