After brexit the key currency pair of Forex market is moving in a relatively tight flat channel 1.10 – 1.1160. The pair was stuck to the lower boundary of this corridor at the end of the last week. All these movements appear around 200 MA, showing to the full extent fundamental market trample without a trend. On Friday we received quite strong retail sales and CPI from the USA. However, traders are not in hurry to bet on dollar, assuming that federal reserve prefers to monitor the stability of the strong data before it continues policy normalization. In one way or other, the chances for rate increase are rising again – from 9% a month ago to today's 44%. Core retail sales increased by 0.6% in a month and by 2.7% in one year accompanied by 1.0% inflation. So called “control group”, close to personal consumption expenditures monitored in the USA, showed its growth in June by 4.3% in comparison to the last year and was 2% higher that the core inflation. What is important: consumers have started clearly increasing their spending after Fed Reserve's rate raising last December. During that period the sales of products of the control group shot up by 2.6%. FRS should not hesitate the strength of consumer demand. But there are still some hesitations that companies, due to worldwide slowdown, may become more cautious hiring new employees. Moreover, Fed Reserve, being afraid to tighten financial conditions in a world alongside with slowdown of the world growth, most probably will be cautious in rate rising. The most important news this week will come from Europe – ZEW release on Tuesday and PMI on Friday.

The British pound desperately does not want to stay lower 1.30 to USD. Last Thursday Bank of England supported it. Contrary to the market expectations BoE remained the rate unchanged, but pointed out most members of MPC consider rate decreasing at the beginning of August, as soon as economic data starts coming after Brexit. A lot of important news from Britain will be released this week, though all of them refer to June: inflation – on Tuesday, employment – on Wednesday, retail sales – on Thursday. It is important to the pound to keep itself upper 1.30. It will support faith in pound among investors.

Strengthening of Abe's party after election on the previous week has brought back speculations about new wave of stimulus for the Japanese economy and has weakened national currency. USDJPY has touched again levels upper 106, but still cannot keep itself there. The downtrend movement, started in the beginning of the year, continues. It can be broken only if the pair rises above 106.60 during coming days.

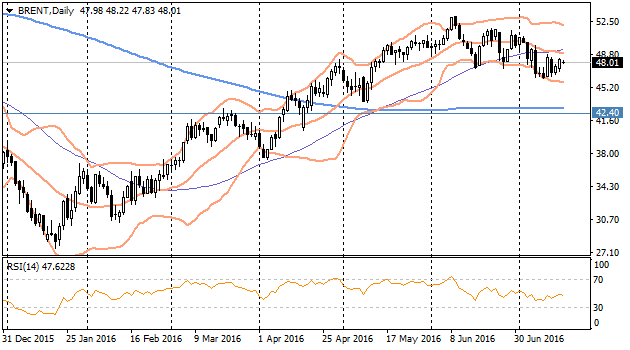

oil traded approximately 10% lower than highs from the beginning of June, but anyway trying desperately to escape the massive sales, which was held these days a year and two years ago. Oil stability is provided by US consumer demand and production decrease. Still it is important to realize the USA are eager to expand their own production, meanwhile the quantity of working drill rigs last week was 10% more than minimum levels from the middle of May. Oil is doomed to the significant correction in the coming days or weeks, however we cannot confidently wait for renewal of the many years lows.