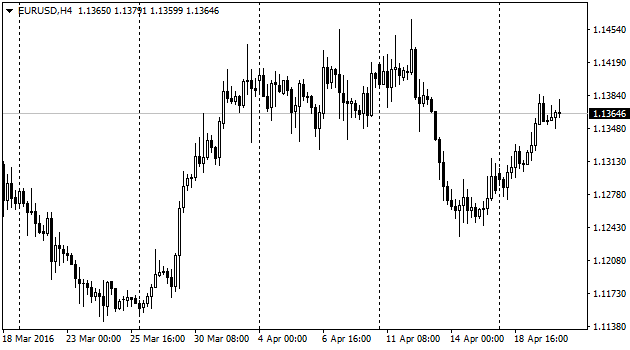

Yesterday the pair was developing its attack during the whole day, almost reaching the area of consolidation from the beginning of April. They did not have enough reasons for firmer step. Tomorrow the pair will face another press-conference of Mr. draghi. Last years this event creates high volatility for euro and can compete with payrolls release. The pair's rise was supported either by Building permits from the USA. Instead of expected growth by 2% it lost 7.7% and this was the decline for the fourth month in a row. Housing starts in March increased even more – by 8.8%. Today the housing statistics continues its releases – will be released Existing Home Sales. Analysts are waiting for increase by around 3.5%. Adding to this indicator may calm down the tension around forecasts of the USA growth in the first quarter. Among European indicators I would stress another inflation drop. Production prices from Germany did not increase in March though they were expecting increase by 0.2%. It did not show any monthly increase since last April. Meanwhile, annual deflation accelerated from -3.0% to -3.1% though they were expecting turn to 2.9%. oil inventories, that usually do not influence EURUSD movement, still reflect the economy of the USA. Released by API oil data once more indicated increase of oil inventories that pushed oil prices. Starting from February, when Saudi Arabia, Russia and Venezuela started to talk about possible production freezing, they had only two weeks when production was cut. In spite of this oil prices added around 60%. Since now we should exclude speculation around possible production cut, we can monitor return of investors interest to demand and supply. API data are not official and traders are following up with high interest the releases made by Ministry of Energy that appear later today. From the technical analysis outlook the pair should fix itself on the current levels or even continue its movement. Success of this action will bring the possibilities of further development and attack against American dollar, and may be resulted as a renewal of many-months lows. If EURUSD will be able to hit 1.14, it will go further not only to the upper level of April trading channel, which is around 1.1430, but much further to the next round mark – 1.15. Alternatively, the pair may come out from very tight uptrend that currently has support around 1.1350. This may lead to more aggressive break targeting 1.1280 and higher, to the beginning levels of uptrend impulse, 1.1250.

GBPUSD

Yesterday pound took the next high, breaking 1.4400 level. This morning market participants were fixing profits on these levels, but very soon the positive movement returned. Turn back to the area of 3-week highs along with positive attitude towards risky assets can be good reasons for buying, and traders may ignore less strong than expected statistics of the labor market. During 3 months, including February, employed population increased by 20k, which is drastically different in comparison with previous month's 116k. Meaning, in February they had huge decline. Moreover, jobless claim population in March increased by 6.7k while forecast was decline by 11.9k. Inflation and unemployment claims remained unchanged – 5.1% and 2.1% respectively. These are good indicators, but they do not change already during several months in a row. Attention of market participants as well is attracted by wages indices. Weekly wages, including bonuses, slowed down from 2.1% to 1.8% for three months, though different surveys were pointing out expectation for the unchanged index and even its rise to 2.3%. The only “green” figure among key indicators was wages index, excluding bonuses. This indicator added 2.2% the same as in January. But we should not take it into consideration talking about reasons of pound strengthening during last hours.

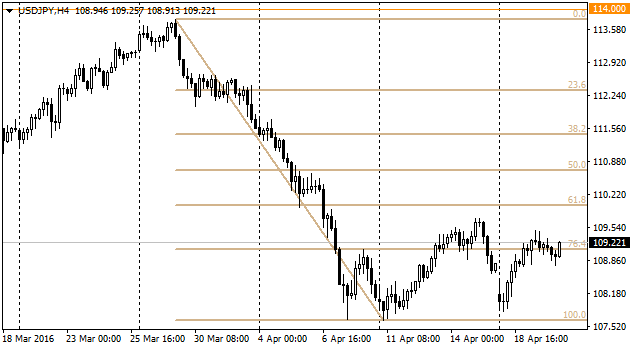

Yesterday pair was not able to continue its attack and stopped near the area of 109.45. Today after small rebound bulls, probably, are making new attempt to push the pair higher. Moreover, they are supported by common relatively positive market trend that backs up many primary and stock markets. At the same time market participants still are critical about possibility of further monetary easing by Bank of Japan. For instance, Kuroda today announced that technical possibility to increase bond acquisition as much as required by the bank, still exists. However, this did not influence quotes at all, but light uptrend movement started lately. Its own statistics had not any significant effect for trading, which is quite usual. Foreign trade showed less than expected by market decline of both import and export against previous year but surplus occurred worse than expectations. Japan was able to reach proficit of external trading but mostly that happened due to import decline (-14.9% yoy) rather than export (-6.8%).

The pair declined yesterday below 1.27 and today again turned to decline after several attempts to go higher than that. Such movement reflects the pair's downtrend since middle of January. Remarkably, today it is difficult to mention oil as a supporting factor for CAD. This time strengthening of Canadian currency, the same as its primary namesake from Australia, caused by demand increase for risky assets. Though, we should be cautious talking about further decline of the pair since it is close to oversold areas both on RSI and Boolinger Bands of daily charts. Yesterday Chairman of Bank of Canada was helping his currency to rally speaking about good economic data but at the same time stressing that these indicators are not stable. Earlier, during quarterly report of monetary policy, Bank of Canada pointed out possibility of economy slowdown in the second quarter after strong indicators of the first quarter. Obviously, market will not stop now unless receives more specific comments from Canadian officials against strength of their currency.