The pair renewed yesterday's daily peaks, persuading traders more and more in its intentions to continue its uptrend after drop on April,13. We should understand that bulls are “walking on the thin ice” since this week ahead we have ECB meeting and following press-conference of the Chairman Mario draghi. Six weeks ago, his comments made during such conference crossed out the whole effect of more than expected interest rate decrease. We suppose this time he tries to present himself not being at the edge of monetary policy possibilities. Moreover, IMF summit held last weekend has reflected less criticizing approach towards ECB policy from German officials that we mentioned yesterday. In addition, Draghi's confidence can be supported by deeper comments of Kuroda, Head of another Central Bank, which has recently accepted negative interest rates. News releases from Eurozone were not simple that boosted the attention for the meeting on Thursday. Payment surplus of Eurozone went down (decline during 4th month in a row), but still remains at a good level of 19 billion. ZEW sentiment index for Germany not only confirmed forecasted increase, but occurred higher than expected level. At the same time publication made by Eurostat released decline of construction in the USA.

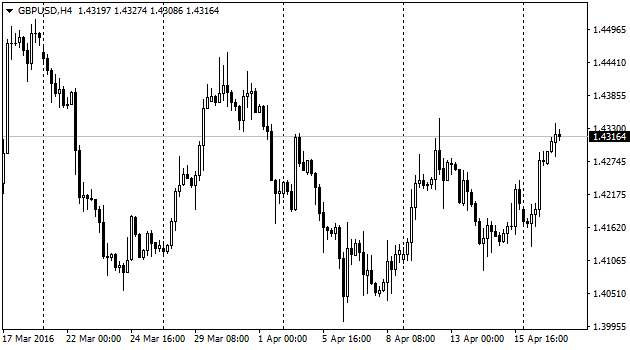

British pound is supported by recovering its wish to take risks on the global markets. GBPUSD has already broke 1.43 and targeting to last week highs. One of brexit surveys has shown significant excess of those who wants to stay in EU: in ORB they say it is about 52% against 43% of those who wants to leave. Though, it's early to celebrate victory for pound bulls since another survey has shown parity of both sides (50/50). Bulls are currently dominating due to positive tendency of the markets. But those retail traders who did not make decision should better cautiously wait for firmer confirmation of bullish mood from market participants, for instance, after reaching 1.4400 level.

The pair again is trying to climb higher 109. It is happening for the short time. In case the pair is able to pass areas of former local highs (109.75) we can more confidently speak about double bottom for it and assume level of 144 yen for a dollar as a next growth target. Kuroda, probably, found what to say about yen. During last 24 hours Kuroda has said that he would soften policy without hesitations in case yen strengthening is not threatening achieving inflation targets. He should say this long ago, probably that could help to convince markets in a stronger way and keep yen from strengthening. But in this situation Kuroda looks like more market analyst who comments tiny yen movements that is not helping to stabilize markets.

Recovering of primary markets and demand for risky assets helped Australian dollar to renew “many months” highs that reached 0.78 level after 10-months pause. Along with the common market rally and escape of funds from dollar assets, aussie was supported by comments of April meeting from RBA. Although it contains hints for being ready to ease the policy if inflation is lower, Central Bank mentioned either that labor market now is much stronger than a year ago. The market has its own vision of inflation – recovering of primary prices during last months increased chances for the consumer goods to grow higher later this year. Rather strong fundamental data of the national economy will not create obstacles for that.