The important support for EURUSD at 1.05 was broken this week. This happened due to more optimistic than expected forecasts for economy and further course of interest rate's hike. In September, markets and the Fed Reserve had something we may call consensus for expectations of two hikes in 2017, but in December more hawks appeared, and eventually they await for three hikes. This goes along with trump's promises to boost economy growth by means of taxes and public expenses. Since the real divergence between monetary policies of ECB and the federal reserve became a driver of EURUSD drop below 1.05, the current fall is the transfer to the new level of the pair, and it is unlikely be considered as a fake breakthrough with the further sharp reverse. It is quite possible for 1.05 level to transform from being the important support during last two years to the resistance of the same importance. The decision of ECB to keep the same QE till next December and optimistic Fed Reserve mood in terms of economy along with hawkish mood concerning rates – all these is making the parity between euro and dollar quite realistic. Yet, it is some perplexity felt on the market, since markets are slowly shifting to holiday mode with less liquidity and volatility. In other words, they expect parity by the beginning of 2017. Euro bears may not have enough liquidity by the end of the current year. Moreover, the movement started at the beginning of November looks quite solid and the pair may be stuck in the range 1.03-1.05 for the nearest two weeks.

GBPUSD

Euro issues did not touch pound, so it was feeling quite good against dollar after ECB meeting two weeks ago. Last week's movement influenced dollar as well, so it harmed the British currency either. Cable pushed away from levels above 1.27 to areas below 1.24. Friday correction allowed the pair return to 1.25, but bears were very active and did not allow the pair to close above the latest mark. If we assume that the main movement of the current year is over, pound can be stuck in the range 1.235 – 1.2550 until the end of the year.

Japanese yen did not lag euro and pound this week, despite it decreased earlier quite significantly against dollar. Eventually, USDJPY at some point this week was trying to climb above 118. The week closed below this level and there was a feeling that bank of japan would state the improvements in economy and inflation in its report after the meeting on Tuesday. Probably, during the press conference we will hear the words which slowdown at some extent the yen weakening, letting it to take a break until the end of the year, consolidating between 117 and 119.

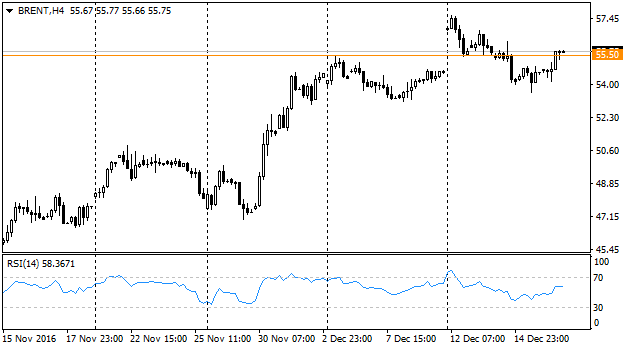

Brent

Oil skyrocketed at the week opening taking 57.50 mark for a moment. But long rally is behind and the lack of drivers caused the rebound with the gap closing and a small drawdown as a reaction to the Fed hawkish mood. Meanwhile, the week closed above highs of the previous week – bulls shown clearly that the market belongs to them. Even dollar's strengthening is not able to destroy this attitude. The US inventories data is still on their side, while oil production increase by 200k barrels a day since summer and fast rise in the number of the US working drilling units is still beyond the market's focus. Do not be trapped. Oil production level remains high.