Last week opening was bad for EURUSD. Prime Minister of Italy has lost the referendum with a big gap. This resulted in pair's fall to 1.05 level, but bulls managed to the keep the attack: EURUSD closed the day around 1.0760, with the intraday range around three patterns. Further, the pair was developing correction bounce during a week. Eventually, by ECB rate decision on Thursday, EURUSD had already two attempts to climb above 1.08. The same as a year ago, markets were waiting for details about further development from December ECB meeting. They did not have instant changes, but the markets reacted actively to the details during the press conference. Firstly, the common currency spiked up to 1.0870, but very soon it became clear that ECB continues its buying along with QE after March 2017 in the amount of 60 billion against current 80. This news is supporting New Year rally of risky assets and pressing euro. On Friday, at some point, the pair was declining to 1.0530. It is important to mention, this time the pair is pushed by the monetary policy divergence. This is a significant point to continue selling euro against dollar. Now all the views are following the Fed Reserve comments mood. Next week the American central bank will raise the rate almost with 100% probability, but analysts are going to search for signs showing how fast the rate increases. Too soft and cautious tone of the Fed Reserve may another time (can anyone count how many times we had this? ) prove the strength of 1.05 level support and create a new wave of growth, at least to 1.08 or further to 1.14. A normal or hawkish mood will cause dollar growth and lead the pair to parity test, making, probably, 1.05 level another strong resistance.

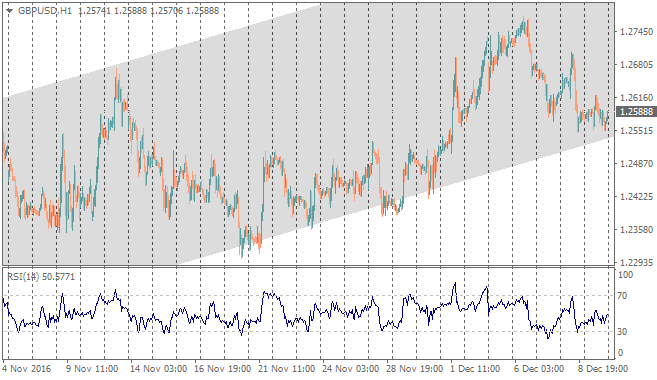

sterling remains in the growth channel since the end of October along with common demand increase. Nevertheless, dollar strengthening was reason of pair swing towards lower boundary at 1.2550. Sterling as well is supported by the rumors about possible softer way of brexit – when they keep the common trade area with the EU. Strong dollar next week may influence the technical picture of the pair. The drop to support 1.2550 will open the way for the British currency to test local lows around 1.24 and later at 1.23. It may take 2-3 weeks more to reach the global “bottom” around 1.21.

Picture here is quite simple: as dollar was declining against other main currencies, it was relatively stable against yen. But as soon as it started the growth again, USDJPY has begun to renew highs from the beginning of the year. The pair closed the week at February highs – 115.36. It can be stopped now only by the extreme cautiousness of the Fed Reserve next Wednesday.

Gold was trying to touch the bottom last week and to bounce from 1160 support. However, the selloff restarted as reaction to ECB comments, and the week was closed below the mentioned level. While the serious support lies only around 1050. Gold was in this area a year ago, caused by ECB QE widening and rate increase by the Fed Reserve. It is very attractive for bears to reach the same point this year.