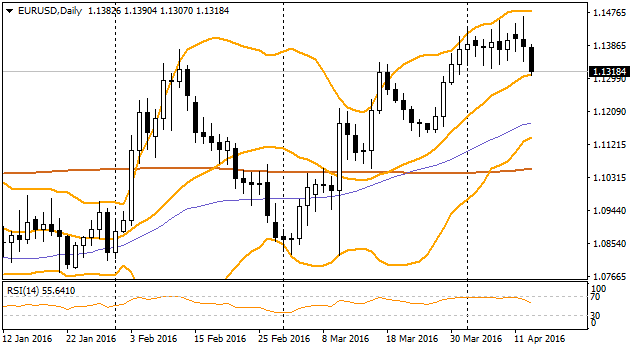

Last hour common currency managed to break the trading channel where it was traded the whole April. EURUSD dropped below 1.1320 that was not reached since March, 31. The turn started yesterday when bulls could not continue growth and stayed above 1.1450. Probably, we witness the turn of the pair but it is quite early to talk about it confidently now, we have to wait for confirmation of closing trades below 1.1320. dollar was supported by hawkish speeches of Williams and Lacker. Williams said that it would be normal to increase the rate 2-3 time during this year. Meanwhile Lacker stressed that estimations of rate increase made in December (four times in 2016) are correct. Both fomc representatives are “hawks” though their opinions sounded tougher than usual and it helped dollar. Export and import prices, doubtfully, could significantly influence dollar's fortune. Import prices added in March only 0.2% against expected growth 1.0%. Export prices performed better, they remained unchanged against forecasted decline by 0.2%. As well, Laker's opinion sounded strangely, he said that downtrend pressure for dollar is in the past. Meaning, they slowly come back to the idea in Federal Reserve that it is time to stop suppressing dollar and boosting primary prices. Inflation will come back to its target faster without such interventions.

sterling could not stay higher than 1.43. Soon after reaching this mark it was thrown back and for some time even dropped below 1.24. Later on, cable recovered but today we notice the bears feeling their power to continue pushing the pair. British currency will not be able, probably, to form its trend before the Super Thursday, when simultaneously will be released inflation report, monetary policy comments and minutes of the meeting. In a short-term sterling is in risk to return to area 1.40 given that they will fix usd profits from the previous decline. As we mentioned above, they start to realize in Fed Reserve that it is not worthy any more for dollar to continue dropping.

Japanese yen is pulling back the second day in a row. USDJPY is now higher than 109 level that was caused by optimistic approach of stock markets after the release of strong data of Chinese external trade. The intermediary goal – 109.50 – has not been achieved yet. Only its aggressive breakthrough may be a reason for a further buying on expectations of yen decline.

Yesterday the pair renewed its lows since July 2015, at some point declining lower 1.2750 and currently trading below 1.28. Recent days rally of Canadian currency is pushed by oil rising but it is easy to notice that loonie recovered much more than oil. The latest managed to climb up only to levels of late November. Today is an important day for the Canadian currency. Earlier in January Bank of Canada helped its currency to turn back. They were forecasting uncontrolled dropping of it soon especially in case of rate decrease by the bank. That would be correct decision for the economy but would be a big threat for the currency. Those days the Bank behaved deliberately and even mentioned positive aspects of the national economy. All the above along with recovery of primary markets helped the canadian dollar. On the previous meeting, on March 9, when loonie was in a recovery phase, the Bank did not see any bad signs in the currency strengthening. Since then loonie has gained 5% more, and their opinion may change a bit. Bank of Canada is able to change trend of its currency but the big question if they will see need of it.