As a whole staying in the trading range the pair is trying to form the growth attempt the third day in a row. Recently it bounced to 1.1460 but very soon returned back to usual levels – around 1.1420. This movement was just a small shade of the usd weakening against other currencies during recent trading sessions. Growth of EUR against USD caused partly by low statistics from the USA that pressure American markets and supported to some extent by usdjpy dropping. However, such theory opposed by quite optimistic attitude of the primary markets and confident behavior of most currencies. This week inflation releases will be in focus of the market. German final CPI data did not surprise markets confirming the first estimation of its return to the positive territory. Price index is 0.3 % higher than last year. Much more attention should be paid to inflation data from the USA. Today they will release Import and Export prices. This data itself is not so important but it will help to identify the inflation trends and make expectations on more important CPI that is released on Thursday and PPI – on Wednesday. Average market forecast is waiting for the first monthly addition since last May. At the same time the annual data is still too far from the positive area – in February we had -6.1%, and March data expected at -4.6%.

British pound showed yesterday a great growth for more than a figure getting higher than 1.4220. Meanwhile, the day highs reached to the area of 1.4280. Today the pound's uptrend was supported by fundamental data. The released inflation exceeded the expectations. The annual CPI has increased by 0.5% though the forecast remained it at the same 0.3% level. Core inflation accelerated to 1.5% returning to levels of the end of 2014. In a short-term perspective Bank of England may face the rising inflation due to stronger internal demand. In the following months it may be influenced either by weakening of the British currency that started in the beginning of this year. However, Bank of England should “look through” these fluctuations and not try to scare markets by possibility of interest rate increase. Moreover, the main risky event for the British currency will take place in June – brexit Referendum. Afterwards only we may seriously consider the Bank's intention for rate's increase.

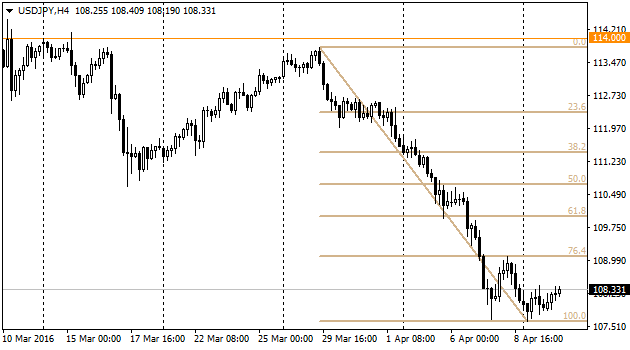

USDJPY

The pair USDJPY feels the bottom only after decline for seven days in a row. Japanese politicians relaxed. They had not do anything. The market is fixing profits itself not having any reasons for the further buying of Japanese currency. Serious intentions of bulls will be confirmed by reaching 108.80 that is actually 76.4% decline correction that began in April. Further, the next goal is going to be levels around 109.50.

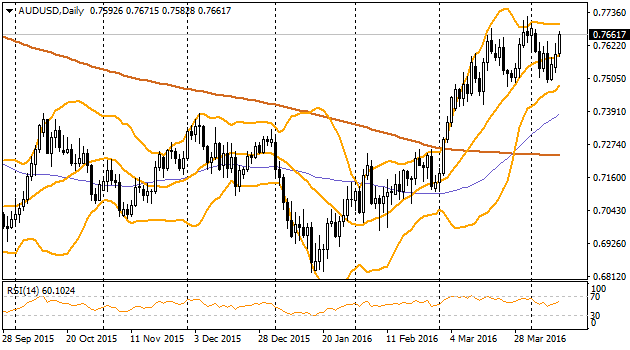

Australian aussie continues growing the second day in a row. Currently, the pair is trying to climb to area of two-weeks highs where peaks were more than 0.7700. Breaking of these levels will once more confirm pair's uptrend since the end of January, while the pause, as a downfall, at the beginning of April allows bulls to generate enough power for the further attack.