Common currency yesterday finally left the tight range. The drop was fast since the traders did not wait for confirmation of a short-term negative impulse, having gathered all the support levels. As the result, common currency is trying to consolidate this morning near 1.1250 level, one-and-a-half figure lower that Wednesday opening levels. It is quite hard for the pair to continue falling in a short-term, hence we can wait for a correction. During the correction it is important to pay attention to a rebound that can transform to the new growth wave. Therefore, it is important to follow up support levels, which are currently perform as resistance levels. The first level in this list is 1.13, then we have 1.1340 (in the first days of April we had plenty of turns here from decline to growth). If EURUSD is able to break higher 1.1350 (for the confidence) we will have a signal that the pair managed to develop its attack and the pair will easily reach 1.15 level, which could not be achieved earlier this week. At night the dollar growth was supported by the release of the Beige book. The report has shown slow increase of retail prices accompanied by acceleration of wages growth. This may influence fomc members to have more positive attitude for the future of American economy. Meanwhile, yellen yesterday again repeated her phrase about necessity of cautious policy approach during rate increase. The USA news released yesterday occurred worse than expectations but it could not affect markets to push the dollar. Retail sales lost 0.3% against expectation of growth by 0.1%. Production prices fell by 0.1% against forecasted growth by 0.3%. It looks like low energy costs influence prices more than expected by economists. This thesis will be tested today on the USA data of consumer inflation.

The day is highly volatile for the British currency and it began wrongly. Cable hardly reached 1.41, losing more than a figure during Asian session due to brexit surveys results. Difference between the sides is shrinking while the share of undecided population is growing. Nevertheless, today the focus in Britain will go to more predictable events – interest rate decision of Bank of England and QE as well as summary of monetary policy. The rate vote, probably, will be solid while summary will emphasize high risk of pound volatility in case of Brexit decision. Suffering sterling may be supported only by the reminder of positive tendencies in the UK economy along with the inevitability of rate increase that is, probably, forgotten by the markets.

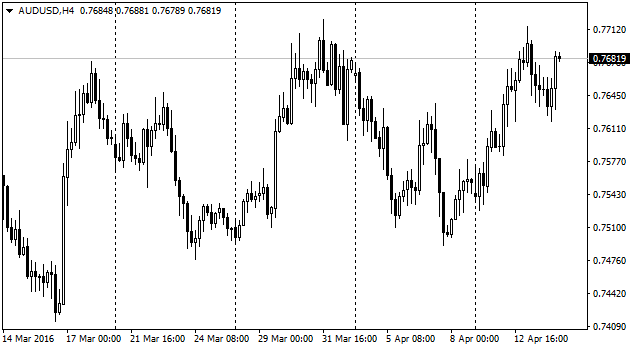

Today, after series of strong news releases of labor market, Australian aussie is feeling this morning much better than its competitors. Instead of increase from 5.8% to 5.9% unemployment fell to 5.7% (share of economically active population remains unchanged). The employed population increased to 26.1 k, but it could be higher, since this figure is hiding the decline of whole-day employed people by 8.8 k as well as growth of half-day employed population by 34.9 k. This cannot be considered as a stable foundation for the steady growth higher 0.77 that is approached by the pair.

USDCAD

Bank of Canada improved the short-term expectations for the economy but worsened its estimations for the second quarter. As a whole, forecasts of inflation and GDP were neutral, hence, traders shifted attention to oil movement. Oil is experiencing correction the second day in a row, forming the rebound of USDCAD to area 1.2900 – 1.2850. The bank did not create any reason for the trend turn, so the only obstacle for the further decline of a pair is lying in oil difficulties to rise from the current levels.