As before federal reserve's announcement about interest rate, pair EURUSD slowly declines without news releases. The reason is the demand growth for risky assets that encourages borrowings in EUR which stands as a funding currency. Though, it's important to realize that scope of euro weakening is less than the two previous escalation impulses caused by ECB and FRS. To boost selling of common currency market participants, probably, willing to have more heavy reasons that will create bearish approach for euro. This is blocked by the confidence of the market that interest rate will reach the lowest boarder received as hints from the Central Bank. Recently appear more and more speeches from ECB officials confirming that «lower rate exists but has not been reached yet». Particularly, last week this was announced by Kerry. Today the President of Bank of France reminded about efficiency of the taken measures but admitted that they are limited. Looks like ECB is trying to persuade markets they can go a bit lower. Nevertheless, it's quite obvious that rate change cannot have the same effect that was achieved when the rate was far from zero. Currently EUR is mostly influenced by the news from the United States. Those may simultaneously stimulate/weaken demand for risks and strengthen/weaken American currency due to alterations in monetary policy. Today, what is usual for Mondays, we experience lack of news. Though, we can pay attention to announced EU current account balance and Existing Home Sales from USA that will be published soon. January data of the current account almost reached the forecasted level showing 25.4 billion instead of 26.3. Nevertheless, this indicator remains healthy for EU. In some way this surplus, probably, could be considered as a reason of EUR stability regardless of the negative interest rate in the region.

Cable has gained a lot during last week. Hence, as soon as markets decreased the demand for the risky assets, GBPUSD became a victim of sales and profit fixing. At the moment it dropped lower 1.44, but still after previous 3-days rally it remains higher than the correction Fibonacci level 61l.8% (around 1.4340). As well that might be a sign for bears indicating quite strong resistance at 1.45. It's vital for the bears to realize that they are not being pulled to the trap as it happened last week.

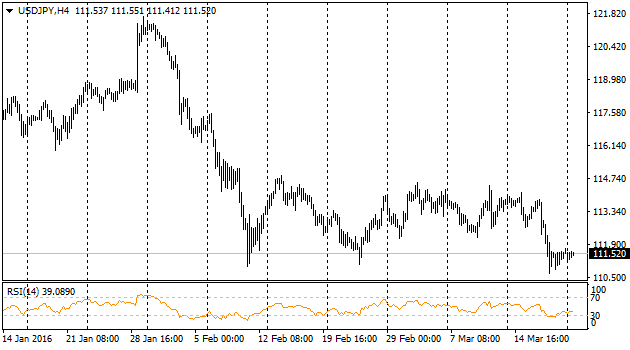

The pair is stuck around 111.50. The trading range was significantly tightened in the second half of the last week. Currently we can observe the very similar picture both on the short and long time-frames: consolidation in the bottom part of trading range after strong decline impulse and the following stabilization. In case bank of japan would buy this pair on a decline lower than 111 that would mean market participants did not have a chance to see such a “buyer” since last Friday.

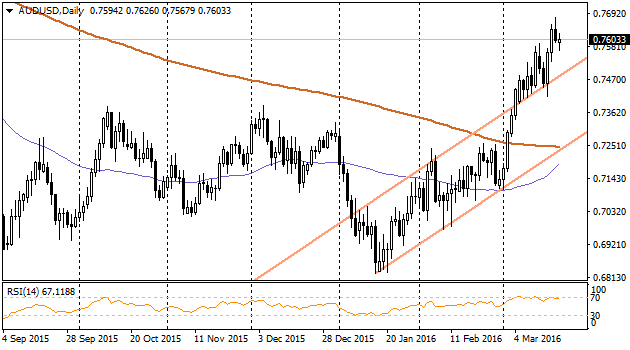

In spite of the pullback on Friday and pressure at the beginning of trades on Monday Australian aussie still is trying to remain higher 0.7600. In the long term Australian currency has shown resistance break by accelerating its pullback from January levels and returning to the support level of March-June of last year. If the pair could pass confidently these levels it may continue growing regardless of fact that it is overbought.