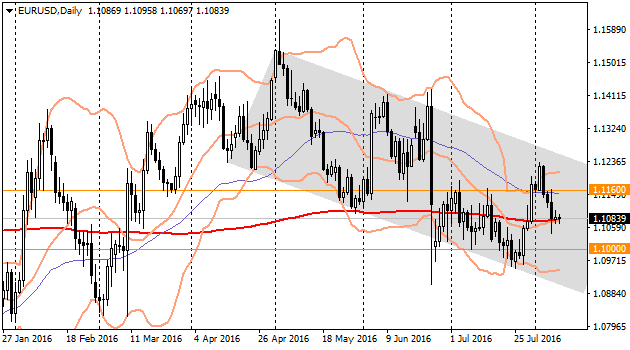

Friday payrolls from the USA appeared strong. It is important to mention that not only employment increased but either wages growth accelerated. Thus, all together those indicators shifted expectations what gave the powerful impulse to buying USD against most currencies. For EURUSD this strong data resulted in a big drop of 110 points and in a support level a bit higher 1.10. At the beginning of the new week the pair was traded around this level, reflecting the traders' search for new impulses. Trade has been consolidating around 1.10 since the end of June. As well the pair is traded currently quite close to 200 MA. The battle for the further trend is going to be long and containing many false movements as the growth we witnessed by the beginning of August and the previous decline. This conclusion is based on the fact that the above stated level was not taken by the strong movement to either sides. If we look at a bigger timeframe we will see that EURUSD has been keeping its downtrend movement since April and turned from its resistance in the beginning of August. If the downtrend movement continues the same pace as before, EURUSD will reach area 1.0800 – 1.0850 by the middle of the month

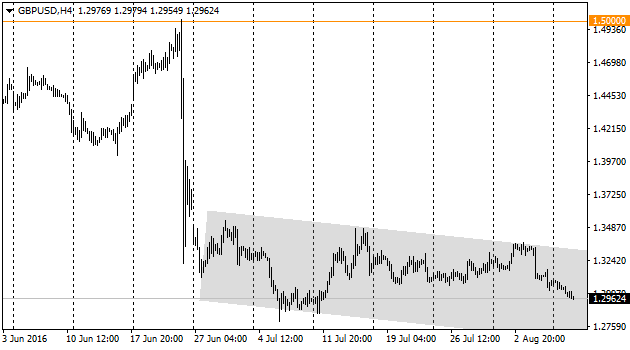

In the GBPUSD pair downtrend as well appears as a prevailing. The Bank of England managed to press its currency (previously neither of other banks could do the same – ECB, BoJ, SNB), offering wider easing policy than was anticipated by the most of market participants. On the contrast with the strong US payrolls divergence of the British and the American monetary policies retuned to the game. pound decline still has an “obstacle” – quite good economy data. However, it is important to realize that traders mostly ignore such data and prefer to react either to the freshest statistics (after July) or to the bad news releases.

The pair as well is experiencing the downtrend corridor, though, unlike two previous cases, it means yen growth against dollar. This is the movement inside the wide channel, but in the less frame we can mention the pair's rebound from the end of the last week. The upper boundary is close to 104 level, but for the tendency identification it is important either to look at stock indices. Their decline can cause the new impulse for the pair decrease. In case events become more serious it is possible the pair will reach 101 level (the decline that was suppressed before several times) and drop to the area 97.00 – 97.70.

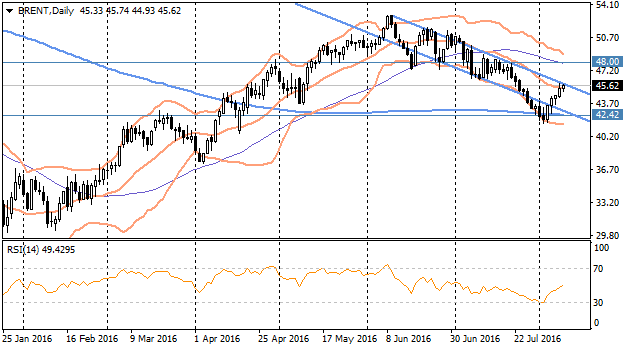

oil has managed to quit the bearish phase. Brent traded again above $45, it retuned above 200-MA and increased higher Boolinger Bands channel –winning back the recent overbought condition. If the bulls like it, they may warm up the market up to 48 USD per barrel – the level of 50-MA and the area of the beginning of its powerful decline impulse in July. In case brave market participants can achieve it, more traders will join them, making the conclusion that last year scenario did not happen.