EURUSD

Low liquidity before the New Year holidays allowed euro bulls at some point to push EURUSD above 1.0650. The year closed above 1.05. However, the start of trading in the new year was marked by restoring of dollar positions, and the pair renewed 14-year highs. Meanwhile, the pair traded again above 1.0550. They cannot highlight any impulse for such dollar weakening. This is only the profit fixing by big players after two months rally of the American currency. Moreover, during this time stock markets were growing, hence, they had either the reasons for profit fixing before the important events on the market. Firstly, it is less than a week left until the inauguration speech of Trump on January, 10. By the moment, we have only his victory speech after the elections. So, Trump is able both to calm down and significantly empower market expectations for the policy of increasing budget spending, reconsideration of trade agreements and totally priority changes for the domestic economy. Before that, on Friday, December payrolls from the USA will be released. As the job market is becoming more and more solid, they should pay more attention to growth rate of wages. Production employment returned to the territory of growth, and it makes us to hope for the good report tomorrow. Surely, negative surprises are possible as well. Weekly unemployment claims in December left November lows that may reason significantly lower growth rate of employment. The issue for December may be a bad weather, which may influence employers' plans. Hence, they should wait for positive influence from wages' side, and for negative – from NFP figure. Technically, the pair's path up will be opened by reaching 1.06 level (pre “new year” movement should not be considered). In case of strong data release, the pair will continue moving slowly but steadily to the areas below the parity.

The British pound is sensitive before brexit, therefore, the resignation of the EU negotiations ambassador influenced badly the pair's quotes at the beginning of the week. However, the US dollar weakening helped the pound to return to the areas of the local highs close to 1.2350. The movement higher may occur on the weak data from the USA on the back of the dollar's return to correction after rally. The further drop is more possible in the nearest future, and the sterling bears obviously are getting ready to try their power to pull the pair lower 1.22, and more ambitious – lower 1.20.

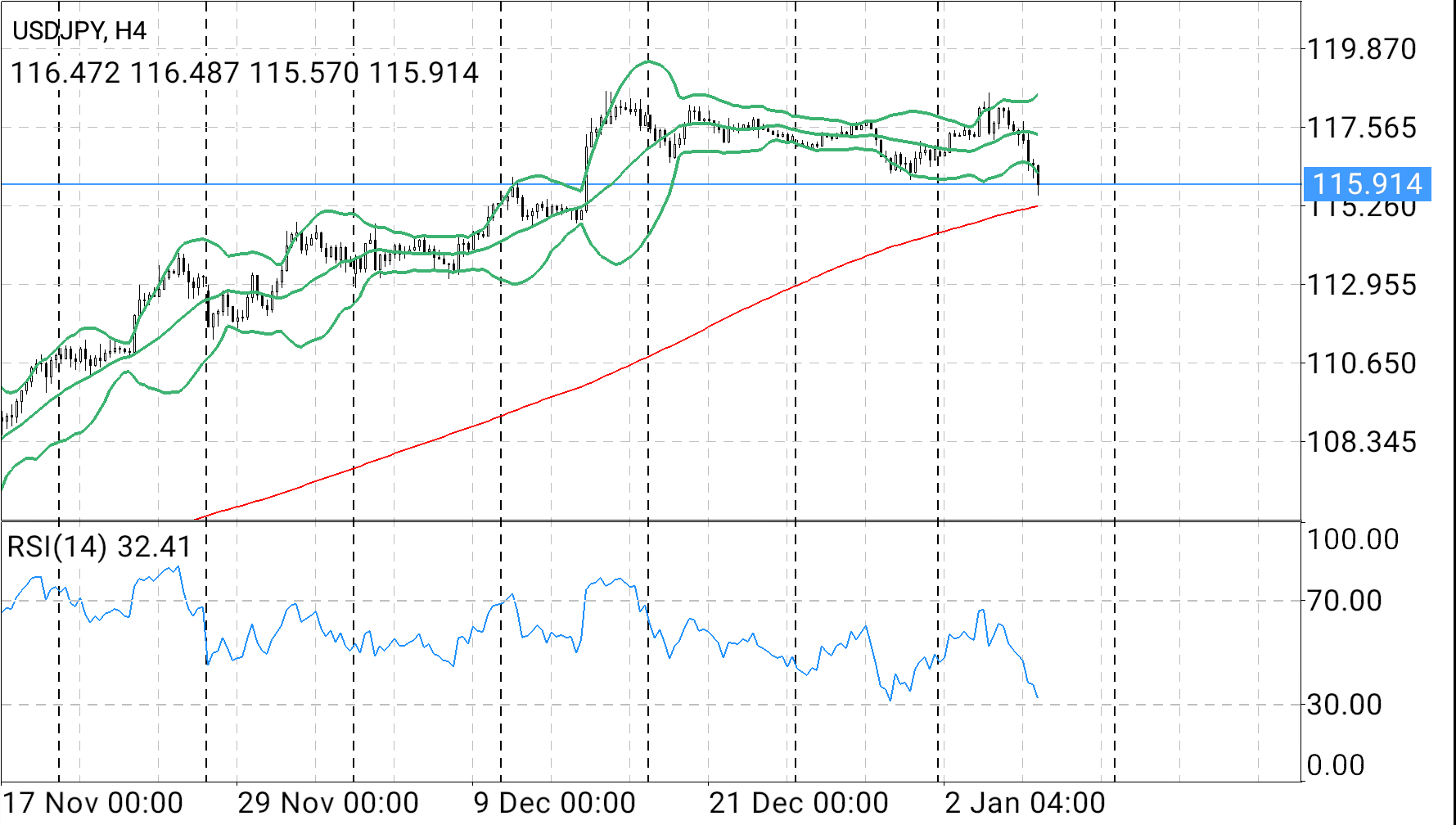

In the first hours of trades in the new year the pair moved to 118.60 which is close to many-months highs, being established several weeks ago. Profit fixing here is more obvious, therefore, today USDJPY managed to enter area below 116. The visible support here is one figure lower. However, they should not join the selling on the current levels without obvious signals from the employment market or elected President of the USA.

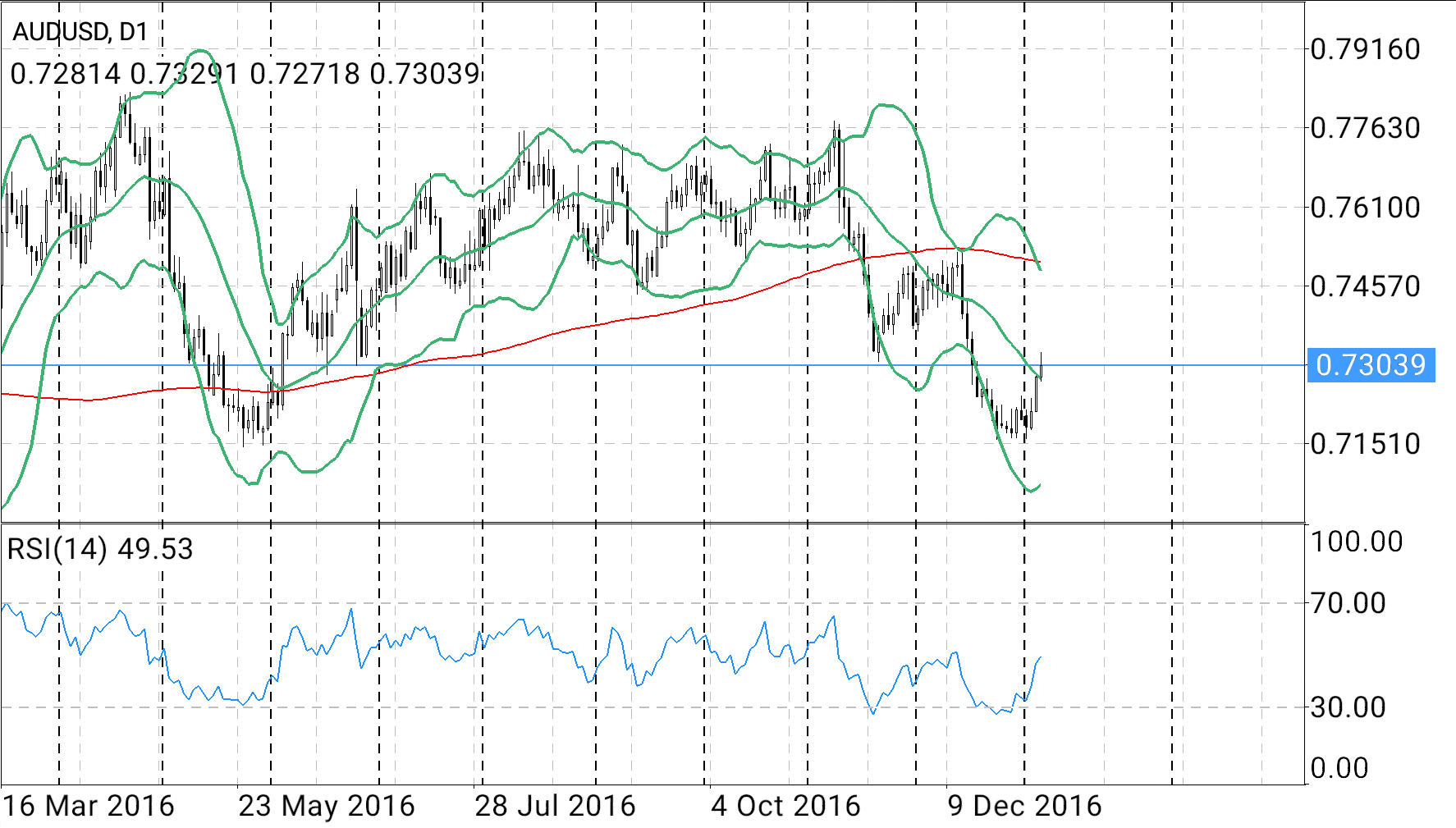

aussie, probably, touched the local bottom on the last days of 2016. From the beginning of the year the pair gained almost 1.5 figures, meanwhile the part of the movement was done during usd growth on the global market. The strong production PMI, released earlier this week worldwide, supported metal prices that helped the Australian currency. At the same time, there are some questions to the stability of this movement. USD weakening will as well suppress risks demand and hurt metals, and consequently the Australian currency.