EURUSD

The current week is after dollar, regardless of the fact that half of the time usd was retreating. The week before, market participants received many signs from the Federal Reserve members about rationality of the sooner policy tightening, but the dollar's rally was not considerably strong, based on their warnings. The markets were waiting for such announcements from yellen. Her Friday speech before long weekend attracted more attention in the situation without other important releases. And she said what she had to say: without stating specific dates, she notified that she is tending towards soon rate raising. Her speech pushed dollar to the growth.

However, on Friday it was moving up without any help from the Federal Reserve Chair. As well dollar was supported by the markets understanding that American economy is doing well: New home sales increased by 16.6% in April. The second estimation of the 1Q GDP was predictably over-rated, durable goods orders exceeded expectations considerably, weekly unemployment claims decreased again (returning to the area of many years lows), external trade deficit fell, as well decreasing the estimations of how fast dollars are leaving the country. The best scenario for the American economy includes moderate dollar appreciation and keeping upward impulse of the economy.

The above will not only help to continue normalization policy by Federal Reserve but as well rid markets of heavy correction fears as soon as rate raised. Yellen was trying to find this edge. On Friday her speech was accompanied by both growth of the American indices and dollar's rising as a whole. Moreover, the global demand for risks as well was increasing, having caused the growth of oil and gold during last hours.

The pair EURUSD lost on Friday almost 100 points while during the week stepped back only for 120 points. This was the fourth week of the pair's decline after the nice turn in the very beginning of May and after the unsuccessful attempt to go higher than the upper boundary of the trading channel (1.150). The further preparing of the markets to the rate increase coincides with our expectations of movement to the lower boundary of the channel – 1.015 and its possible breaking, since ECB is still too far from the idea to start policy tightening. So, euro will fall against market growth the same as yen.

The British pound was trying for the second time during the month to enter area higher 1.47. The brexit survey results helped as the share of population voting for staying in the EU increases. Still GBP traders cannot sleep easily due to the high share of those who did not make a decision yet. Media talks that world community uselessly pushes British population stressing the economic suitability. For them this is the question of sovereignty, we can say freedom and not the economic benefit. Such propaganda from the outsiders may reason “remonstrative voting” for EU leaving.

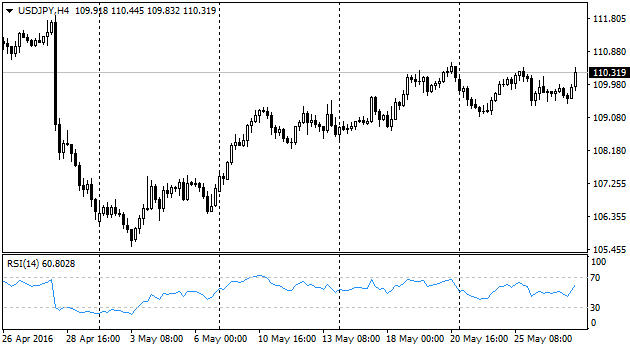

The pair was under pressure at the beginning of the week, getting to 109.00. Later the pair managed to recover by means of other markets. But the last week's levels – around 110.50 – still were not reached. Published on Friday, core inflation was slightly higher than expected: decline in April compared to the last year is 0.3% against expected 0.4%. But still this is the deflation which comes back to Japan. Leading price indicators from Japan show that the tendency going to remain in May. The most optimistic of all measures –core inflation estimation by the bank of japan – could not resist the decline either and decreased to 0.9% in April from 1.1% in March and its pick of 1.3% in December.

Gold

Gold was under pressure during the whole week almost without a halt. Dollar strengthening and growing confidence in world's economy growth deprived the gold of its “safe haven” attractiveness. The prices were also influenced by the fact of dollar appreciation itself in which this precious metal is quoted. Gold lost around 90 points during two weeks moving to the area of April lows – a bit higher 1200 per ounce. The only hope now for gold bulls is the demand for this asset as a hedging tool against inflation. But currently it makes uncertain steps, therefore, in order to grow during coming several months gold needs either new wave of fears about world economy development, as it was last July – August, or signs of growth acceleration regardless of the rate increase “threat” by Federal Reserve.