During last week, the pair was going up, coming off slowly from the support line of the wide uptrend channel since last December. If we look to the pair movement through this channel, we can notice that movement in May was indicative (two previous movements took almost the same time) and fast movement from its upper boundary to the lower. However, the probability to break the support of the uptrend channel was quite big.

At least federal reserve members were helping it a lot, showing, one after another, that possibility and necessity of a soon policy tightening exists. Still market participants were not in rush to bet and instead were waiting for the next ECB meeting and Friday employment data. draghi, like Federal Reserve officials, was doing everything he could do to push euro and promising to ease the policy as much as needed for reaching target inflation. However, at the same time he could not miss the better perspectives for growth and inflation, as per released forecasts of the ECB administrative staff.

Though, euro was pressed on Thursday, since along with Draghi's speech several employment indicators from the USA were released. Unemployment claims were falling the third week on a row and had reached 267k – the five-day low. ADP data as well was promising strong Friday employment report: new jobs in the private sector was as expected 173k in comparison to the last month's 166k.

However, Friday news appeared as a big unpleasant surprise. NFP change was only 38k, in the private sector – 25 (difference with ADP by 148k or almost 6 times less). Moreover, last month statistics has worsened. Economic active population dropped to 62.6% against 62.8% a month before and 63.0% in March. This is the turn of trend to the decline and to 40-year lows area, observed in September (62.4%). The drop in unemployment rate from 5.0% to 4.7% in these conditions explained by the decrease of population, actively present on the market.

As result of such weak data the American dollar received serious pressure. By the end of trading day on Friday EURUSD shot upwards 240 points. Probably, this is not the end of uptrend. Its resistance now appears at 1.1650 level. Still previous two times it took around two months in this channel to make the way from the lower to the upper boundary. During this resistance will rise to 1.1859 area.

Now we should wait for more cautious speeches from the Federal Reserve officials. They will unlikely cancel the idea of two rate increases during this year, but we should not expect the rate raise in June. In the best-case scenario it will happen in July. Moreover, this will be possible only in terms of stronger data from the labor market along with the positive tendency of inflation and consumer spending.

GBPUSD

Friday labor market data helped the British currency to return its losses against dollar, that appeared after unexpected results of Brexit survey. Phone survey held on Monday showed “surplus” of those who wants to leave EU – very bad start for the agitation campaign. Probably, they hoped in the Government that advantages of EU membership are obvious and shared by everyone. It turned out they have to fight to retain status quo. Meanwhile, volatility becomes the main sign of the sterling. The uncertainty of the currency price movement is so high that the best advice now is volatility targeting (for instance, via option strategies), and not the specific level for the pair by the end of July.

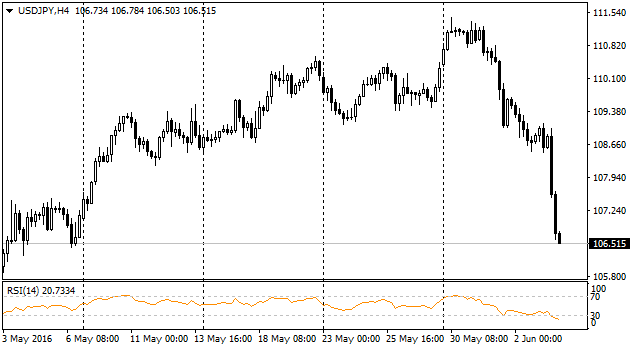

USDJPY

The reason of the USDJPY growth last week was not only labor market data from the USA. Apart this, the Prime Minister of Japan, Abe, has postponed the second round of sales tax raising in order not to suppress additionally the economic growth. Such step will influence the reconsideration of inflation forecasts, including bank of japan. Price surge will not occur without this raise, meaning inflation, both actual and expected, hardly can move up. USDJPY closed the week at 106.50, which is one of the lowest levels of closing during more than six months. If the market continues selling the pair, getting rid of the dollars, the Bank of Japan will need new stimulus wave to stop unwilling and significant appreciation of the national currency.

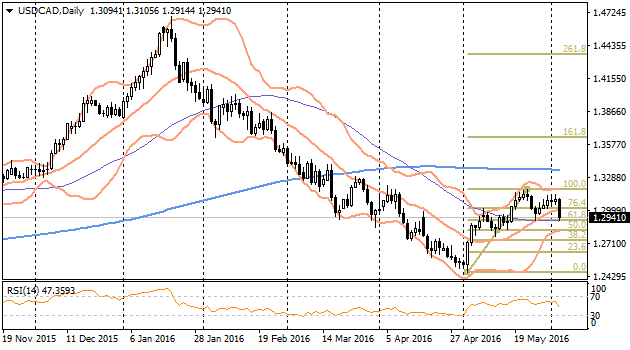

usdcad

Traders of the canadian dollar were trying the whole week to buy pair cautiously on the weak macroeconomic perspectives of the Canadian economy. Eventually, by Thursday the pair was trying to fix above 1.31 level. Losing payrolls crashed all attempts of bulls to turn the pair to the uptrend. It dropped below 1.30. Probably, it is going down to 1.28 area – to the support area observed in May. There lies as well 50% growth level from the beginning of May. The best strategy for the pair looks as follows: let it to drop to the support level due to overestimation of the usd perspectives and after that buy the pair for the short-term target around 1.32 and further – to 1.3350 (200 MA) and 1.3650 (161.8%). Fundamentally, the pair growth supported by obvious slowdown of the Canadian economy due to forest fires, as well as recommencing of the drilling activity in the USA, that is promising to increase productions and to push oil in the nearest future.