The pair is showing that short-term bottom was formed in the end of last week. At the moment it reaches 1.13 without any significant news and comments. More confidently we can comment the short-term turn after hitting resistance level at 1.1320 (38.2% rebound from April peaks), then the nearest target may become 1.1350 level, and later on – 1.14 and 1.1450. In the news today we are waiting for release of Housing market index from NAHB, though we are not expecting it can move market seriously. Tomorrow's Germany and Eurozone ZEW Economic sentiment have much more chances to move the market. Analysts assume “fluctuation near the bottom” but with the positive tendency, expecting growth from 4.3 in March to 8.2 in April, as well as growth of Eurozone indicator. In the weekend, during MFI meetings, we saw unexpected change in the comments of German officials. Schaeuble softened his anger to ECB, while Weidmann pointed out that situations in Germany and Eurozone are different and ECB should consider the whole picture, stressing that in such conditions monetary easing is acceptable. Is it so bad situation in Germany now?

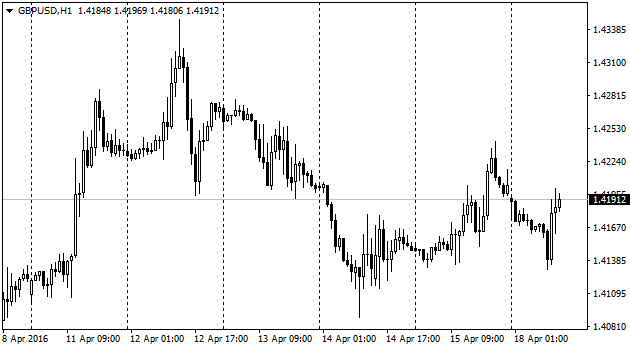

Cable is remaining in the trading range without any special reactions to g20 or opec comments. GBPUSD currently is a bit lower than 1.4200 meaning close to levels of the week opening. Low volatility is explained by quite lose schedule of the economic calendar. Housing prices from Righmoveadded gained in April 1.3% the same as a month ago. Annual inflation is still high at 7.3% but agency commenting the report speaks out about high demand before the preference period for the duty tax is expired.

The opening with the gap today is reasoned by several factors. We have here escape from risky assets due to earthquake in Japan as well as unmade decision in Doha that suppressed demand on stock exchanges along with the G20 engagement not to allow competitive devaluations. For Japan such committal means that country will not get formal approval in case of devaluation of national currency via Cental bank's policy and therefore direct interventions to Forex. Now we should switch our attention to Abe. The Prime Minister had earlier warned that only disaster may influence him to change the reform course and not to increase taxes. Disaster is here, though not so tragic as it was in 2011.

oil lost more than two dollars in the market opening on Monday, for a short time going lower 41 for Brent and touching 39 for WTI, due to OPEC inability to make an agreement on production freezing. Market reaction could be much more visible if we did not have confidence of traders that oil production is already near to highest capabilities of the oil-producing counties (reserving the remaining at the same levels production profitability). Oil bulls, probably, will try to close the gap, meaning rise prices to 43 dollars per Brent barrel. Even in case they manage to do this we should remember that now market participants will exclude the possibility of freezing until Iran and Saudi Arabia, the main offenders of canceled agreement, make the real bargain. Now oil has much more chances for the long-term (one-two months) decline turn while it may reach again 30 level.