EUR/USD

The single currency is still being attacked by bears. These traders have decided to take advantage of the moment and sell the euro at a higher price due to the previous correction. Besides, as has already been mentioned, in the periods of such surface lull, trading volumes are quite handsome, which enables players to store liquidity for a serious attack. Unfortunately, it is hard to understand which stance big players will take. Now it seems that the euro's correction is coming to its end and the pair will soon reach fresh highs since the beginning of October (below 1.2500). Now trading is held at 1.2630, which makes decline by a figure against yesterday's highs and is 2 figures below the levels set two days before. At the current levels the pair already reversed up a week ago, but then it was reluctantly falling already at 1.2650. Now bears feel more confident and it is not only because of the ECB's clear adherence to easing the monetary policy, but also because of the improved US statistics. On Tuesday there were quite favourable data on the housing market – they indicated growth of the existing home sales. Yesterday we also received a bit more bullish inflation statistics from the USA. The consumer prices grew by 0.1% a month, while investors hadn't expected any changes. The annual inflation rate didn't slow down, remaining at 1.7% (against the expected slowdown to 1.6%). The monthly core index, however, hasn't met the expectations. So we get that fuel and energy prices are falling slower than expected. It is very unexpectedly as recently the price of oil has considerably reduced and America is famed for flexibility in its energy pricing. This is particularly surprising against growing inventories of Oil and oil products. Yesterday's statistics by EIA indicated increase in inventories both of crude oil and distillates. It put pressure on Oil and made stock exchanges correct, boosting demand for USD. eurusd has an important support at 1.2600, where it reversed on October 10. If this level doesn't hold out, bulls' defeat can be finally proclaimed.

GBP/USD

Yesterday the pair slipped down following the single currency, though the domestic news failed to give any support. gbpusd was easily deprived of a figure in the heat of the EU session, yet no one could push it below the important level of 1.6000. Further in the day the pair was consolidating above 1.6030 and now is trying to climb up to 1.6050. All these attempts to grow shouldn't mislead you as the support level of the short-term uptrend was broken 2 days ago and yesterday's drop only consolidated the situation.

USD/JPY

The pair is gradually getting back to the weekly highs, settling down above 107.00. It is quite likely that the ascent here will go on faster, should we break through 107.40 – a weekly high and the upper bound of the consolidation in the previous two times – last week and in mid September.

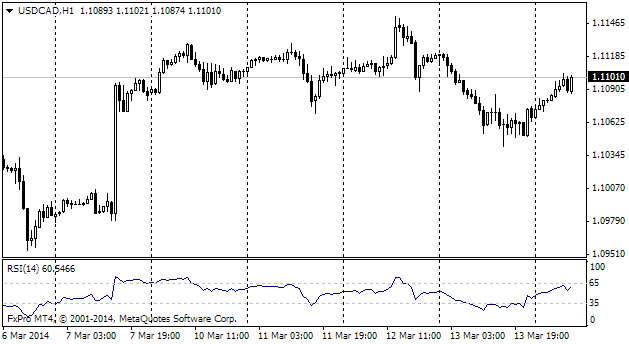

USD/CAD

The shooting in Ottawa made the CB officials cancel their public speeches. We are left only with the prepared press releases on the monetary policy (the commentary to the rate decision and the quarterly report on the monetary policy). The commentary reports acceleration of the core inflation, which is actually offset by the decrease in the general index caused by the reduction of energy prices. It helped the Loonie come to its senses and grow against the dollar. However, the pair soon resumed growing against the global reduction of Oil prices and appreciation of the US currency.