News and Data:

– January 08: US ADP Non-Farm Employment Change 202K vs 160K expected

– January 10: US Non-Farm Employment Change 145K vs 162K expected

– January 14: US CPI M/M 0.2% vs 0.2% expected

– January 14: US Core CPI M/M 0.1% vs 0.2 expected

Market Update:

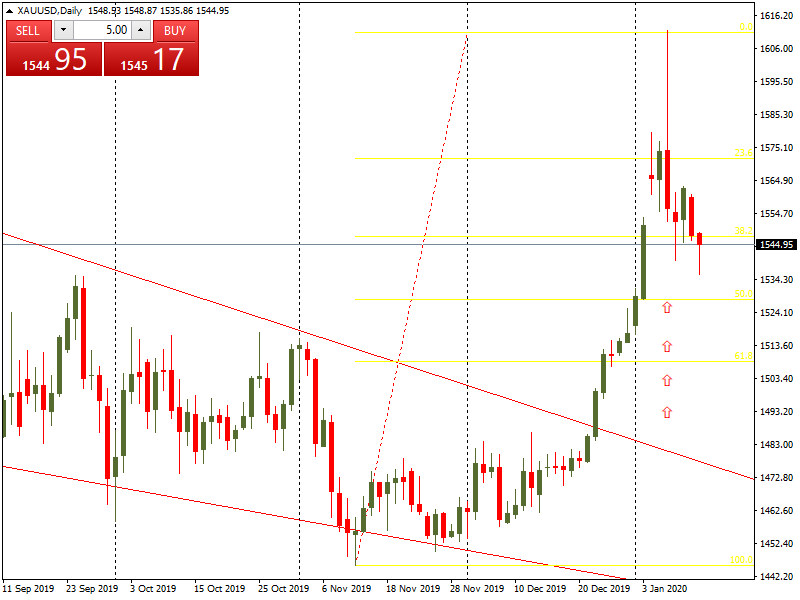

Gold prices rose to seven-year highs around $1,613 an ounce last week after Iran attacked the US military bases in Iraq. However, gold is struggling to find its bullish momentum at the start of this week and apparently the prices has softened to around $1,540 an ounce as a reflection of geographical tension ease with Iran, and the signing of a phase-one trade agreement between the United States and China which has taken place nearly two years in the making. The details of phase-one agreement are unconfirmed but according to experts the agreements are split into nine chapters dealing with issues more…