News and Data:

– January 08: US ADP Non-Farm Employment Change 202K vs 160K expected

– January 10: US Non-Farm Employment Change 145K vs 162K expected

– January 14: US CPI M/M 0.2% vs 0.2% expected

– January 14: US Core CPI M/M 0.1% vs 0.2 expected

Market Update:

gold prices rose to seven-year highs around $1,613 an ounce last week after Iran attacked the US military bases in Iraq. However, gold is struggling to find its bullish momentum at the start of this week and apparently the prices has softened to around $1,540 an ounce as a reflection of geographical tension ease with Iran, and the signing of a phase-one trade agreement between the United States and China which has taken place nearly two years in the making. The details of phase-one agreement are unconfirmed but according to experts the agreements are split into nine chapters dealing with issues including technology transfers, food and agricultural purchases expanding trade, and financial services. According to CNN political analysis Katie Lobosco “This deal is to expected to leave tariffs on about $370 billion of goods, or nearly two-thirds of what United States imports from china.” With these new trades are uneasy.

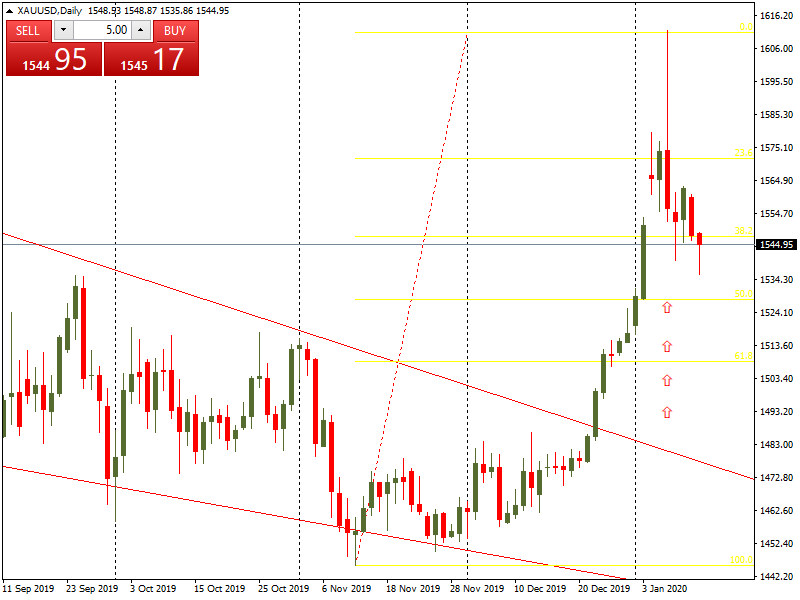

Technical Analysis:

Gold had a break out at $1,543 support level and moved to around $1,535. It has started to retrace to around $1,543 again, which is the opportunity to sell. The next target is $1,524 and $1,500 level or even below. Buy zone is between $1,524 and $1,500.

Upcoming Events:

– January 15: US Core PPI M/M and PPI M/M

– January 16: US Core Retail Sales M/M and Retail Sales M/M

– January 17: Chinese GDP

– January 17: US Building Permit

– January 17: Prelim UoM Consumer Sentiment