It has been a bad week for worldwide stocks, and most major indices are down by around 5% for the week, with further losses expected over the next days.

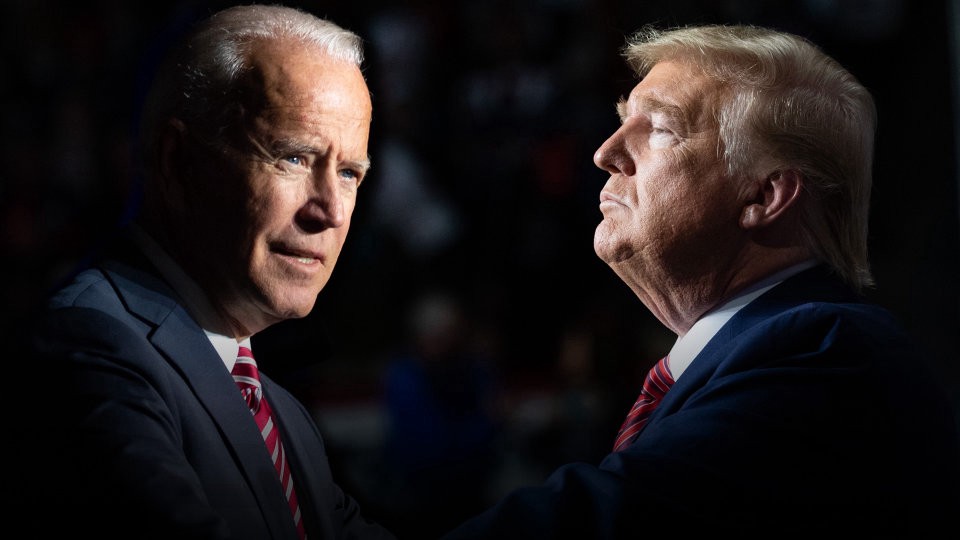

But don’t blame it all on the election. Yes, there is some uncertainty building up, especially if Joe Biden wins, but the odds are that each candidate has narrowed to 50/50. Biden’s recently revealed corruption scandal is hurting him, while Trump continues to attract huge crowds in his rallies.

As many keep saying stocks only go up in the long-term, no matter what party reigns or who the president is.

Worse than the election, are COVID-19 more…