EUR/usd

The US inflation stats came as an unpleasant surprise for the dollar-bears yesterday. It turned out that consumer prices in May grew by 0.4%, which is twice as much as expected. The annual inflation instead of staying at 2.0% grew to 2.1%. Of course, it is too early to speak about the radical change of the situation, however now the Fed surely has less space for maneuver. In accordance with the classic economic rules, increased consumer activity has led to faster price growth. Apparently, in the coming months we'll see much of this. The seven meager years after the subprime mortgage crisis are gradually coming to their end, so the economy and consumers are getting back to their normal behaviour. To prevent a new mortgage crisis we should erase its original causes, that is extremely mild mortgage terms, which then were based on mild regulation and now – on historically low interest rates. In this regard the slowdown in the housing market, albeit a nuisance, will still look as quite a steady condition. As on the one hand the demand will be maintained by strong fundamental factors and on the other hand it will be under pressure of tougher mortgage terms, which will cut off a part of potential borrowers. Right in this connection, the decrease in the number of housing starts and building permits by 6.5% and 6.4% respectively shouldn't be treated as a reason for the Fed to abandon tapering. On the contrary, the fact that in May a standard mortgage was just 0.17% above its historic low indicates the excess of incentives for banks and too low rates in the markets.

GBP/USD

As opposed to the USA, the British inflation data proved to be less strong. On the contrary, the entire package of statistics for May (yesterday's housing prices were for April) fell short of expectations. The consumer prices dropped by 0.1% per month and the annual inflation slowed down to 1.5%. It is hard to raise the rates when inflation can't reach the target and the expensive sterling promises to spoil the situation even more. Producer purchasing prices have again decreased by 0.9%, just like in the preceding month. Over the first five months they have shrunk by 3.5% and over the last year – by 5.0%, and from their peak in March 2013 – by 8%. All this has enabled producers to keep sale prices unchanged (payroll costs are still growing) since August 2013.

USD/JPY

The Japanese trade balance doesn't stir optimism and confidence about success of Abe's reforms. At least now. But the fact that these data proved to be a bit better than expected already made a cause for optimism in the Japanese stock exchanges and intensified pressure on the yen. usdjpy has been above 102 for a day, which can be a signal of movement to the top of the trading channel of the recent weeks, i.e. to 102.75. But yet it should be kept in mind that yesterday's decision of the Fed bears risks of higher volatility. So, we should be cautious right after the release of the commentary and in the course of Yellen's press-conference.

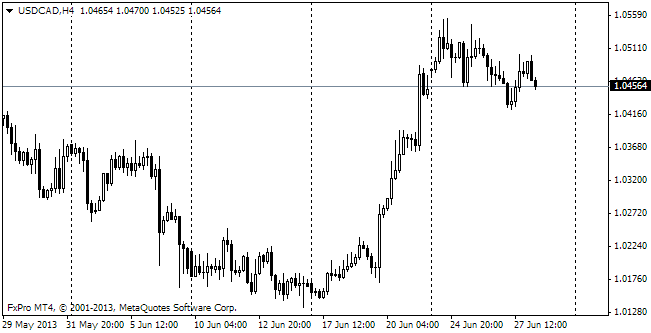

USD/CAD

The Loonie is showing signs of bottom formation at 1.0840. If so, the upward movement from the current 1.0866 above 1.0875 may provoke purchasing at least to 1.0940. Yet, today there will be little domestic news in Canada, so this movement can be aroused only by the news from the Fed. But it has the potential to ruin any technical picture. Even if a chance of it is little.