EUR/usd

The mild yellen has remained her own self. Against our expectations that FOMC would learn a lesson from the financial crisis and would choose another policy for the Fed, it treated the macroeconomic forecasts with great caution after the poor beginning of the year. The long-term GDP forecasts were slightly revised down. Though at the same time the spread between the rates increased, thus reflecting a more hawkish mood than earlier. The markets preferred not to focus on the last moment, seeing only caution regarding the future measures. The markets got quiet about the possible acceleration of tapering and approach of rate increases. Also Yellen brushed off the worries about the bubble in the asset markets, which sent stocks up to new historic highs. In the currency market traders longer dealt with the cobwebs of comments, so the euro/dollar at first was fluctuating between 1.3550 and 1.3590, but eventually bulls got the upper hand. The pair closed Wednesday at the upper bound of the mentioned range and now is trying to attack 1.36. The American currency was under pressure across the board and, considering the signals from the ECB's officials, we can expect quite a quick recovery to 1.3650, the current level of the 200-day MA. And here we need to carefully watch the events. The dollar's ascent seems to hang up again.

GBP/USD

The cable is again above 1.70. This time it feels more confident due to weakness of the US currency. Again there are attempts to kick the bears out, triggering an avalanche of stop orders. Fundamentally, growth is boosted by quite a decisive mood of the BOE, which judging by the minutes, was surprised earlier in the month that the market didn't expect rate increases before the end of the year. Now after mentioning of this fact by Mark Carney, it expect them. The British press report that getting back to normal times opens the way to 1.8 or even to 2.0 for the pair. Yet, we should remember that the sterling was above 1.7 only for 5 years since the end of 2003. Before that, for over 10 years, it had been trading within the 1.35-1.70 range, where it returned in late 2008.

USD/JPY

The dollar/yen keeps moving horizontally . Weakening of the US currency caused the pair's return below 102. The trip to the upper bound of the 100.80-102.80 range is put on hold. It seems that bears are dreaming to push the pair down to the lower bound. Besides, special attention should be paid to the 200-day MA, which already for over 1.5 years has been a strong support for the pair. Now it is passing through 101.56 and close to this level we can expect increased volatility.

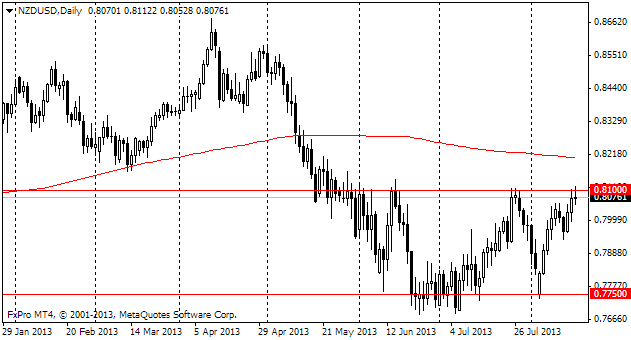

NZD/USD

The Kiwi-traders are so inspired by the CB's resoluteness earlier in the month that almost completely ignored the weaker than expected economic growth in the first quarter. Analysts expected to see growth by 1.2%, but it made 1.0%, just like in the 4th quarter of the preceding year. Against the first quarter of the previous year the growth totals the impressive 3.8%, thus dispersing all worries about the economic growth in New Zealand.