EUR/usd

Yesterday the euro was under pressure due to another tide of demand for the dollar. The US currency again enjoys popularity in view of growing concerns about the oil price wars, unleashed by Saudi Arabia. The main player of opec agreed to lower the release price of oil for China, which entailed higher pressure on the global oil rates. For the most part, this policy of Arabia comes from the intention to preserve its share in the market and keep the USA out of the shale oil business. It is supposed that if this business remains on the edge of profitability, absence of substantial investments into the industry will make it impossible to raise technological effectiveness and reduce the cost price. Roughly speaking, now the US shale gas companies profit when the price is above $80 per barrel and in a year of good investments this level may go down to 70 or even lower. So, lowering the oil price now, Saudi Arabia cuts off the oilfields (including a part of Canadian and Russian ones), where extraction is not very easy and cheap. In its turn, it unwinds the downward spiral of prices on other commodities and puts pressure on the consumer inflation rate. The latter ruins the prospects of inflation growth in the eurozone in the near future. If earlier in the preceding year and a half the slow price growth was caused by the poor demand and growing euro, now the sharply depreciated energy resources can become a serious obstacle on the ECB's way out of disinflation or even deflation. But it is in the long term. In the short term the euro-bulls should be cautious in their expectations of further pullback. Fundamentally, the US dollar has a better chance to continue growth than the euro – to continue adjusting its recent decline.

GBP/USD

As has been warned, the British currency fell under pressure after the release of poor inflation statistics. Almost all the components, monitored by the market participants, proved to be worse than expected. The consumer prices didn't grow in September (while growth by 0.2% was forecasted) and the annual inflation slowed down from 1.5% to 1.2%. The producer prices lost 0.6% in September (against the expected -0.4%) and the annual decline remains impressive (7.4%). The producers, in their turn, are reducing their release prices. For five months in a row they have fallen by 0.1%, as a result, losing 0.4% against September 2014. After such inflation statistics today all eyes will be riveted on the earnings growth even more than on the domestic employment statistics.

USD/JPY

The stock exchanges have gone off the lows, also due to the oil depreciation. In its turn it has helped the yen-sellers. The pair has been consolidating around 107.20, right where it had consolidated in mid September. Today the markets are again negative and it means that the yen may again come in demand (the pair- go down). Should it fall below 106.70, the next important support will be expected already below 106.00.

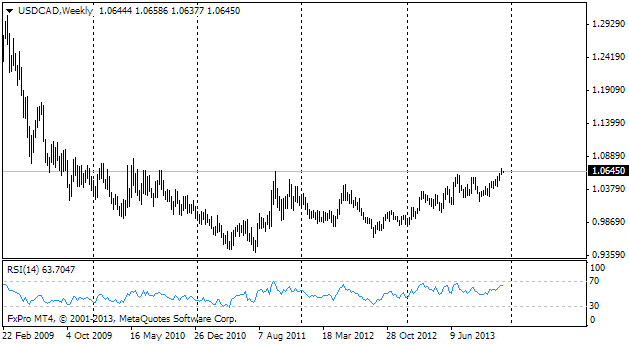

USD/CAD

The peripeties around Oil put pernicious impact on the Canadian currency. The Loonie has reached 1.1360. Last time the pair was that high in July 2009. Then the local high was above 1.17.Thus, bulls still have enough space for growth. The main risk today is posed by the release of the Beige Book of the Fed. However, the report on the regional activity in the USA will hardly be able to reverse the downtrend in the Canadian currency.