EUR/USD

The bulls found enough strength to repel another attack against the euro on Friday. It would have been too impudent of them to put the euro/ dollar down to another local high for the third day in a row, depriving it of over two figures. It didn't happen though and the situation was developing under the basic scenario, that we had described earlier on Friday. eurusd was gradually rising to 1.3800 and even got above that level for a while. Anyway, the week was closed below that level, the general downtrend still holds. The geopolitical tension around the Ukraine is still high, and the mutual sanctions will do harm to all the involved parties. Last week ZEW reported worsening of economic sentiment, attributing it to the situation in the Ukraine. Today we look forward to the release of the regional PMIs. The preliminary data on manufacture and services sector will be published at the beginning of the EU session. Now it is expected that the rates will be close to those of the previous month, confirming the ongoing growth of the region. On Saturday ECB deputy head Constancio spoke about further growth of the region, albeit with the inflation suppressed. For comparison, when the growth held barely above zero for a couple of quarters, the Fed's and BOE's officials were actively discussing the policy easing and were guided by deviation from the trend growth. In this regard, the ECB's position is traditionally less stimulating and is focused mainly on low inflation rates. As we see, even changing of the Bank's governor hasn't produced much effect on the alignment of forces: with the economy growing we shouldn't hope for easing of the monetary policy by the ECB. Thus, the only factors that can now put the rate under pressure are stronger demand for the US dollar and flight of investors from the EU currencies because of the growing geopolitical crisis in the east of the region.

GBP/USD

Unlike the euro, the British pound was still kept under pressure on Friday. Having opened the day a bit above 1.6500, it managed to close it only below that rate. Let's recall that both the euro and the pound surrendered their important closing levels to bears, which may lead to stronger pressure this week. Today we don't expect any important statistic, so all attention will be paid to the dollar. Tomorrow, however, we'll get inflation stats, which may either do even more harm to the British currency or, on the contrary, help it recover from last week's losses.

USD/JPY

Growth with which the Japanese markets started the day contributes to appreciation of usdjpy. The Japanese currency suffered some losses after the Fed's announcement, but didn't go into a downtrend, unlike the euro and the pound. The Japanese yen is still in demand due to increased risk-aversion. It's quite possible that bulls will keep purchasing the pair as technically the euro and the pound surrendered their important levels while USDJPY managed to close the week above 102.

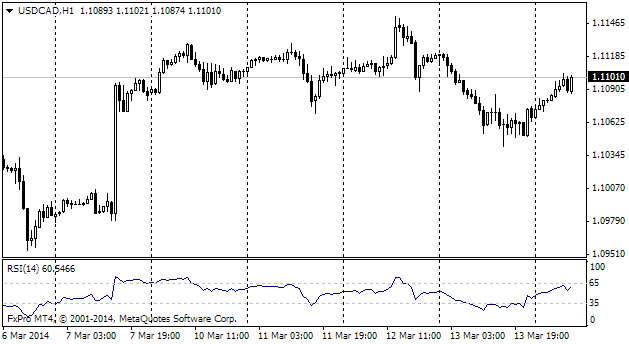

USD/CAD

The canadian dollar experienced a moment of flight on Friday, when the strong retail sales data and higher inflation provoked profit-taking in the pair, which was trading close to its five-year highs. On Friday the pair for a while fell from 1.1260 down to 1.1175, but now it is trading at 1.1230. As reported by the statistical agency of the country, retail sales grew by 1.3% in January against the expected 0.8%. It doesn't make up for the drop by 1.9% a month ago, but makes the picture a bit brighter than supposed earlier. The consumer prices rose by 0.8% in February, due to which the annual CPI slowed down to 1.1% against the expected 1.0%. The Loonie's decline in the recent months will spur consumer prices up at least for the next half year.