EUR/usd

Hardly had we written about the threat to the local lows in the pair yesterday when the pair was pushed below 1.27. The major part of this decline took place against liquidation of stops after hitting the previous lows. Formally, this selling occurred when draghi repeated that the ECB was ready to continue its unconventional policy to avoid inflation risks. The pair came to its senses only at 1.27. Here it got support and now makes new attempts to consolidate. There are no reasons for growth as the eurozone keeps releasing poor news while the US labour market, according to weekly unemployment claims, feels quite well. The index of consumer climate in Germany has been falling for two months in a row. Adding the decline of business sentiment indices, we get the least rosy picture. And this is for Germany – the driver of the EU economy, which felt better than others in the first half-year. By contrast, the US unemployment claims have been below 300K for the last two weeks. And the number of continuing claims, albeit has grown from 2432 to 2439, still remains within the clear downtrend, which strengthened in August. However, we should pay attention not only to these short-term statistics. The retail sales and PMI are also worth considering. Today we get data on the US Final GDP in the second quarter. It is expected that they will be revised up from 4.1% to 4.6%. If so, the Fed's hawks may get stronger and cause growth of the dollar against most other currencies.

GBP/USD

The British currency feels quite confident since the threat of policy easing by the BOE has been lifted. Though yesterday's selling of the euro put pressure on the pound, it managed to offset its losses already till the end of the day, so Thursday's decline proved to be minimal. But in long term the pair is moving within the uptrend, which is actually a correction after strong overbuying at the beginning of September. Besides, players seem to be in need for portfolio rebalancing as since July the cable has lost over 10 figures. Thus, the end of the month can be favourable for the British currency.

USD/JPY

The yen doesn't hurry to yield. The pair is fluctuating near the level of 109, having recovered after yesterday's selling by a figure to 108.40. The pressure on the pair is growing as the stock exchanges are developing correction. And the BOJ is getting more space for maneuver regarding the monetary policy. After the upsurge, caused by the tax increase, prices again started sliding down. In August the annual inflation rate slowed down to 3.3% from 3.7% in May. It exceeds the Bank's target, but we also should understand that QQE initially was meant to get into 2% of inflation in 2015, should another tax increase occur, whereas the latter is quite doubtful now.

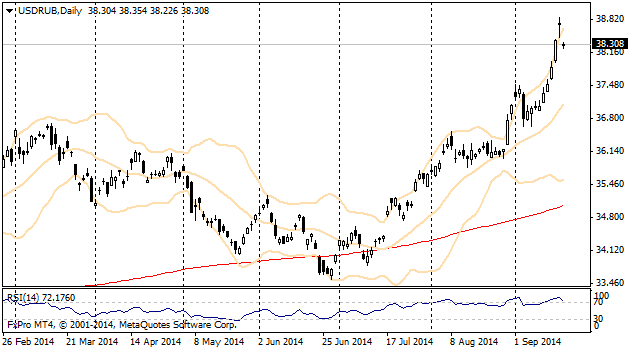

USD/RUB

The dollar/ruble has hit fresh historic highs, now being very close to the level of 39 rubles per dollar. The currency is affected not only by the geopolitics and economic slowdown, but also by the arrest of one of the Russian oligarchs and seizure of Sistema's stake in Bashneft . The market quickly recalled the beginning of the 2000s and Yukos affair.