EUR/usd

The end of the previous week and the beginning of this eventful week passed under the banner of USD's growth against EUR. Against our expectations of rebalancing, the pair hit fresh multi-year lows. Now trading is held near 1.2675, which hasn't been seen since November 2012. However, taking into account that then the low of 1.2662 didn't exist for long, the current levels can be confidently called the lowest ones since September 2012. This week the major risk for the pair is posed by the ECB's regular meeting and the following press-conference and also by the US employment statistics for September. It is expected that the ECB will provide more details on the ABS buying program despite the increased opposition of hawks, finding bond purchases by the ECB risky. So, if draghi doesn't manage to defend his point of view, the Central Bank may confine itself to another mention of its readiness to act should risks to the financial stability of the region grow. Besides, low bond rates in the eurozone, including the periphery, and low demand for TLTRO at the beginning of the month show that such measures are actually unnecessary. The eurozone now needs to be confident about further growth, then banks will start issuing loans to business and households. The US employment now enjoys positive forecasts. The market participants mainly expect growth by 220K, which is close to the average yearly rates and write off the disastrous growth by 145K a month ago to one-time factors.

GBP/USD

The cable is depreciating due to strengthening of the US currency. Now trading is held at 1.6230, which corresponds to the levels hit on September 16. Hourly charts show divergence between the price and RSI (14), which in its turn speaks about the potential of a short-term rebound. But in the meantime, it is too risky to stake on growth of the British currency. In the bigger timeframes it is clearly seen that the pair has resumed falling after the rebound on the positive results of the elections.

USD/JPY

Since the end of the last week the pair has been making attempts to hit a fresh six-year high. The current high makes 109.53. This week promises to be eventful, so we can't exclude a possibility of growth above 110 as well as the beginning of a normal correction. The nearest high, 110.50, is within the reach now, so in our opinion it is very likely that the market will move towards this level and launch a correction afterwards. Tomorrow data on employment and household spending are published. These statistics are also able to strengthen the yen and put additional pressure on it.

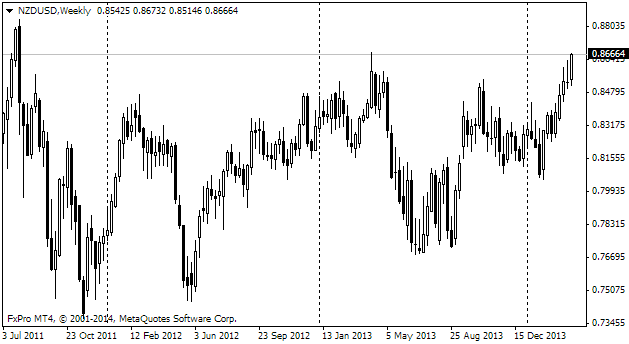

NZD/USD

The Kiwi sank after the release of the RBNZ's sales statistics. The CB sold 521bln NZD in August, while the average monthly rate had been 3bln since the beginning of the year, which is the highest rate since 2007. Such statistics shows that in August the CB tried to put pressure on its domestic currency, most likely, against the AU dollar. The pressure is put not only by the CB, but also by Prime Minister, who in one of the interviews mentioned that the most acceptable rate is 0.65 against USD. It is much less than the current rate of 0.7750. Three months ago the Kiwi was worth 0.8830, i.e. 12% more. The current levels are close to the lows of the previous year. Should the depreciation continue, bears may target at 0.7450.