EUR/usd

Yesterday bulls managed to warm up the euro/dollar so much that the pair crossed the 200-day MA. There were even attempts to catch hold of 1.37, yet they proved to be futile as there were no reasons for such a movement. Generally speaking, yesterday's growth of the pair was more of ‘against' than of ‘due to'. The German retail sales fell by 0.6% in May instead of growing by 0.8% as expected. That was ignored by the markets this time, though earlier the markets had met the index with anxiety. The preliminary inflation estimate in June proved to be weaker than forecasted. The annual rate remained at 0.5% against the supposed growth by little 0.6%. Yet, we should point out increase in the core index to 0.8% from 0.7%. However, it should be realized that even in this case the inflation is far off the ‘close, but below 2%' target. But if this doesn't give a chance of QE extension by the ECB, nevertheless it is a good reason to stick to the current policy a bit longer than supposed before. The positions of hawks in the committee will be definitely undermined. Further there was the USA with its strong growth of pending home sales. Though the annual indicator remains at 6.9%, that is below last year's rate, the decline by 9.6% was still expected. Yet the monthly growth made 6.1% (against the expected 1.4%). The market managed to ignore all that news. The major influence on yesterday's movements was produced by the cash flows upon the end of the quarter. The portfolio rebalancing contributed to weakening of the dollar, which actually grew slightly last quarter. Further we expect continuation of USD's appreciation. The fundamental indicators contribute to strengthening of the US currency, which should again come in the foreground on the markets' return from rebalancing to investing.

GBP/USD

The cable was radiant yesterday. Finding itself at 1.71, it celebrated the beginning of the new quarter at the highest point since October 2008. Actually we have doubts about steadiness of the current levels, yet the British currency is supported by a series of the positive economic reports and also by the stronger hawkish sentiment among the BOE's members. Many investment banks are reconsidering the forecasted date of the monetary policy tightening, bringing it closer. We still believe that the current rate of the sterling will hamper economic growth.

USD/JPY

The Tankan quarterly survey of the Japanese corporations, published today, has proved to be worse than expected and marked decline against the previous quarter. The optimism of large manufacturers has subsided, both manufacturing and non-manufacturing indexes have fallen short of expectations. The positive aspects are improvement of the outlook and current estimate for small manufacturers (which are not many in fact) and also the estimate of the Large All Industry Capex. Naturally the yen has proved to be under pressure, which has helped usdjpy come off the lows of 101.30, yet bulls still have been strong enough only to get to 101.45.

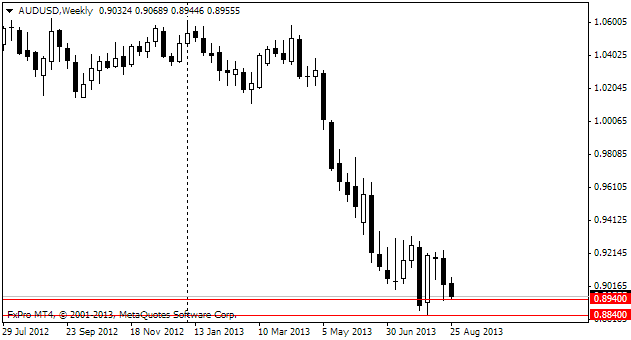

AUD/USD

The Australian CB kept the major interest rate at a record low level, still preferring to help the economy slow down its growth by means of extractive sectors. Stevens commented that the historically high rate of the aussie hinders this process. It should be mentioned that the recent peak of commodity prices accounts for these movements. Because of that and also of weakness of the US currency the Aussie reached the highest rate since last November.