EUR/usd

There's another portion of good news from the US housing market. New Home Sales surged up by 8.3% to 497K annually in June. Against June 2012 it makes the increase of 38.1%. Yet, here we should mention a steep decline of the median home price to 249.7K against 262.8K a month ago and 282.1 two months ago. Remember that on Tuesday we learnt about a 1.5% decrease in existing home sales , but at the same time were struck by the sharp rise in prices. Apparently, Americans preferred new homes as there appeared offers to the buyers' liking. What did yesterday's release show? It showed that Americans are getting more and more confident about the future and have broader opportunities for purchases. Let's add here historically low mortgage rates and an incentive to make use of it now, as ‘tomorrow' it can already be late. Under such circumstances Americans will be eager to increase real estate purchases in the coming months. The main issue for us then will be to identify where the line which separates a bubble from recovery lies. Is growth of sales and/or of prices by a third over a year not a bubble yet? Aren't the historic highs in the stock markets and closeness to the historic lows in the debt ones enough to announce bond-buying reduction in the near future? Against this background new growth of bond yields (against the two-week highs yet) is obviously just the beginning of a long way. It is also true that the Fed will have to make its way along this path – the path of gradual tightening of the policy. In our opinion, this is exactly the thing that the Fed's future chairman, who is to take up the post next year, should be able to do. However, the name of Bernanke's successor hasn't been announced so far. eurusd was trading between 1.3250 and 1.3170 yesterday. The upward move was caused by positive PMI statistics from Europe and the downward one – by the US housing stats.

GBP/USD

The pressure of the US news on the British currency was stronger than on the euro as the sterling had no support from the strong PMI statistics. The cable fell as low as 1.5290 during the US session, though before that it had reached 1.5390. Technically, selling got more intense after breaking through the support line.

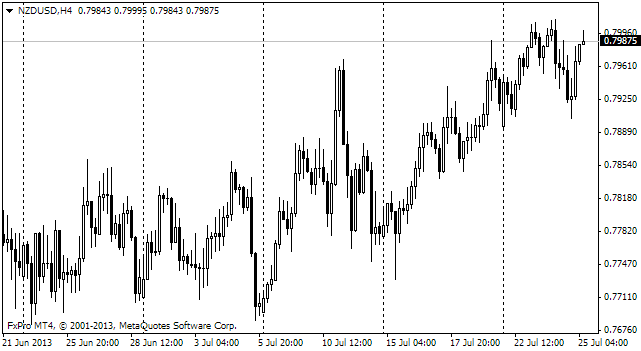

NZD/USD

The Reserve Bank of New Zealand, without any surprises, kept the main interest rate unchanged at 2.5%. Anyway, the Bank's head, Graeme Wheeler, in his comment to the decision noted that economic growth is getting stronger and spreading to more and more sectors. With such comments Wheeler risks attracting too much attention to the Kiwi. For example, in less than 12 hours nzdusd has grown by almost a figure and is now testing 0.80.

USD/CHF

Swissy has stuck in the corridor. It is a good sign as such continuous consolidations are usually followed by strong and continuous movements. And here the picture is forming in favour of growth. Probably, there will be new attempts to go below 0.9340, but it seems that we can expect good growth within the next few weeks. Be on the alert not to miss it.