EUR/usd

The single currency suffered heavy selling. Before that, earlier in the day, bulls had tried to attack and pushed the pair up to 1.3966. But then it was no easy matter to find a reason to purchase the euro. draghi's comments and concerns about growth in China delivered a double hit to eurusd. The ECB governor said yesterday that the forward guidance (implying that the rates will remain at the current or lower level for a long time) would, most likely, put pressure on the single currency. Besides, he added that strength of the currency was getting more and more important in estimation of inflation prospects and economic risks. So, he put as much pressure as he could. Anyway, that was quite expected from the EU officials, who try to carry out an accommodative monetary policy, but face growth rather than depreciation of their domestic currency. The news on China had been released in the morning, but only in the afternoon we heard that investment banks one by one started to revise down their forecasts on the GDP growth for this year. Yet investors have been particularly disappointed by the fact that the Chinese government doesn't hurry to unpack incentives, preferring to put up with lower growth rather than once more stir up the bubbles in the domestic market. The number of stimulation rounds in the previous years have already formed a significant disbalance, which can only deepen should the policy remain the same. For instance, the authorities express open concern about growth of housing prices in big cities and also about an impressive increase in the debt load of the local authorities, which have sought to keep its growth rates high. The US market lost over 2% for less than a day, the euro/dollar dropped to 1.3850, i.e. to its usual levels since the end of the previous week. Besides, don't forget that passions around the Crimea are rising, this Sunday there will be a referendum on its annexation to Russia. The main thing here is not a result, but the reaction of Russia and the Western world to the situation. Just like two weeks ago, the negative scenario may deal a serious blow to the markets.

GBP/USD

Without its own drivers the pound completely fell under the influence of the market trends. And they contributed to growth of risk demand in the morning and to a sharp change of this sentiment in the afternoon. Since Draghi's words concerned the euro, the sterling simply returned to the levels of the beginning of the day. Trading is again held a bit above 1.66. Yet, today's trade balance statistics may become a real challenge. Anyway, investors' attention will be mainly turned to the situation in the Crimea and Sunday's referendum. For stock exchanges and of course for the pound it may result into heavy selling. It is quite possible that it will be this very trigger, which will launch the long-awaited correction of the pound against the dollar.

USD/JPY

The demand for safe assets again aroused intense purchasing of the Japanese currency. Just like before we don't treat the current decline as a long-term trend: after the first impulse money will again flow from the low-yield yen into more attractive assets. Even if the situation remains difficult and the stock markets are under pressure, there is a lot of currencies and bonds, promising much more profits. So the current situation can be used to search for the right moment to purchase the pair.

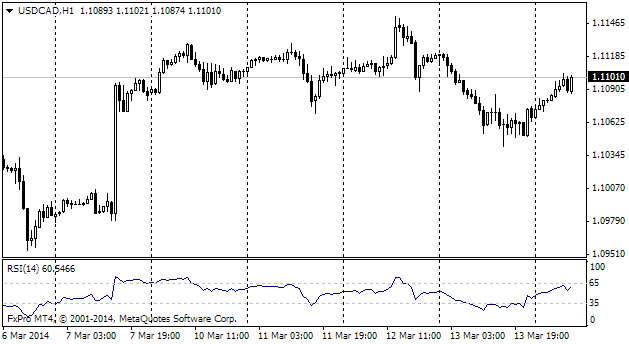

USD/CAD

The canadian dollar is living its own life. Feeling no pressure from the geopolitics, the Loonie managed to escape selling in the afternoon. As a result, the pair closed the day in favour of the Canadian currency. In the meantime, it should be mentioned that now it is not the best time to stake on depreciation of the pair. This instrument can be used at best to hedge growth of the dollar against the EU currencies.