Traders could not resist the tension. After quite stable growth inside a tight channel the pair broke its support at 1.1350 and went down for more than a half figure. Today traders have enough time before the coming draghi's speech, therefore they are not in hurry to buy cheaper euro but instead boosting selling. Except risks of monetary policy, pressure to common currency caused either by higher demand for risky assets that makes the protective function of the common currency less attractive. Moreover, we should notice good indicator of home sales. Existing Home Sales in March added 5.1% that was higher than expected level of 3.5%. Sales level reached 5.33 m (yoy) that is very close to average data of the previous 12 months (5.29). oil inventories in the USA once more increased but that did not cause any oil waves since at the same time oil production dropped to the lowest level of 2014. Today market is waiting for Unemployment Claims. Last week Primary claims were at the lowest level for more than 40 years. This week the rebound is expected to more regular levels around 265k. However, the USA data today will have the secondary interest since the same time Draghi announces the results of the last monetary policy meeting. One and a half months ago ECB was trying to surprise markets by significant rate decrease. Later we found out that they were planning even bigger decrease. However, euro sharply turned up from declining after Draghi's phrase “it's all for the rates”. This was accepted as a sign of limitations of monetary policy and was resulted as a growth of the common currency. Probably, Draghi was right since oil and other primary resources have been seriously increasing last time indicating the inflation growth in the nearest future. So the further steps may not be required. But markets should realize that the Bank has all the tools for the later pushing to the desired direction. We believe that during coming conference Draghi will discuss this a lot and try to press the common currency. Though, it is hard to forecast if he is able to do that. Earlier, both Kuroda and Draghi did not manage to change the market sentiment by one press conference.

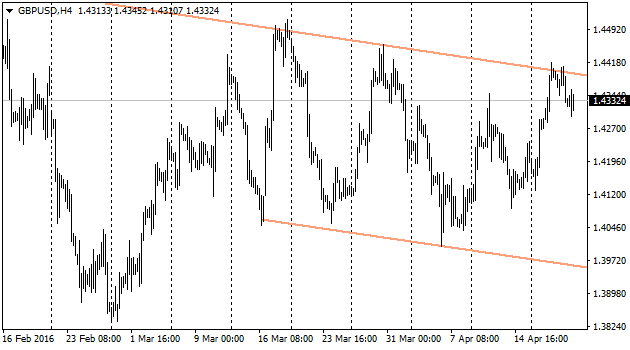

Cable could not stay above 1.44 getting under pressure at the end of the trading session due to weakening of US stock markets and pressure to euro. Meanwhile, pound could successfully withstand weakening of its own news. Today bulls' confidence again not so strong caused by low retail sales data. The indicator lost 1.3% in March after drop in February by 0.5%. In comparison with the last year it added significantly (2.7%) but the impulse is losing its power as in January it reached 5.4% but in February was only 3.6%.

The pair managed to go through 109.5. Now it is heading further growth to 110.20 area in the nearest future and later on – to 111-111.30, to the former support area of the pair. The final target of this short-term impulse may be increase to 113.50 area, which was the start of dropping at the end of March.

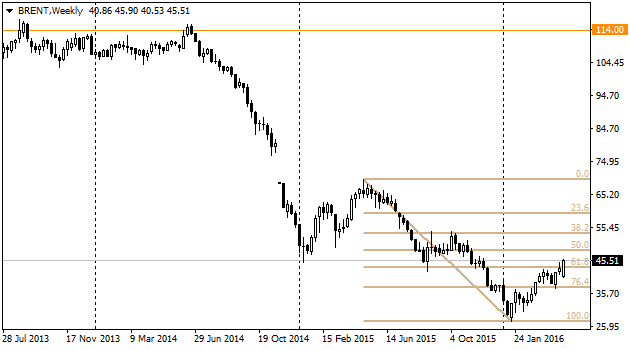

After unsuccessful start on Wednesday, oil was able to renew yearly highs by the end of the day and fix itself again above 200 MA as well as touch overbought areas of RSI Boolinger Bands. Moreover, this growth indicated the move higher 61.8% of decline from the middle of last year. Now bulls may target 50% level that is higher than 48$. More ambitious traders, obviously, target 50USD per barrel.